public sector

Jonathan Sanders, Director, Research, GovExec

For any public sector company, there are many ways to measure success. Whether it is winning a recompete, successfully branding after a merger, or diving headfirst into a new agency and winning a contract, the constant growth of the public sector marketplace offers new ways to win and remain competitive.

For all of those wins, there is one common denominator you cannot succeed without: Customers.

Your customers are ultimately the driver of your brands’ success in the federal marketplace, and if you are ineffectively serving them, your business will ultimately suffer.

Without customers that are willing to go out of their way to refer your business, you end up relying on word of mouth or your historical track record. Sure you may have delivered on your brand promise to your customers twenty years ago, but is that still the same today?

Creating Customer Advocates

In today’s highly competitive public sector landscape that sees an increasing number of companies vying for contracts YoY, acquiring customers is just the beginning of the journey.

To truly thrive and build a sustainable brand, transforming your customers into advocates can be a game-changer. Customer advocates are not just satisfied clients; they are enthusiastic supporters who go above and beyond to promote your brand.

Their word-of-mouth recommendations hold immense power in driving new business and strengthening your reputation.

In a continued effort to dig deeper into what drives customer loyalty, Leading Brands seeks to answer this question by surveying hundreds of public sector employees about what brands can do in order to spur this customer advocacy.

The Public Sector Leading Brands

The highlights of the study provide valuable insight to any company working with the public sector: whether an established player in the market or a company just entering the arena. Serving as a benchmark, the study looks at a variety of factors from how brands are perceived across multiple public sector verticals, customer vs. non-customer information, or the brand’s association with leading concepts such as Cyber, Digital Transformation, AI, and Cloud, and more. It then dives into whether the brands deliver on their promise.

Learning what government decision makers feel about these topics provides insights any marketing or business development team can leverage.

Join the Conversation

Overall, the Leading Brands study offers a succinct view into the question of brand positioning and tracking. It is the largest government decision-makers study capturing the priorities and perceptions of buying teams across federal agencies.

On September 21, 2023, GovExec will release the 2023 Leading Brands results with help from some long-time colleagues and leaders in the public sector. The breakfast event will include a panel discussion with public sector leaders. Among other things, they will discuss what marketing can do when the clients do not have a great perception of the brand.

The breakfast event is our gift to the GovCon community. At this complimentary breakfast you will:

> Learn who the top brands for 2023 in the public sector market are

> Hear about new aspects of the study that give the results more meaning

> Network with the leading brands

> Hear from an expert panel about how brand perception and customer satisfaction are connected… and what that means for you

Registration closes on September 18.

Successful companies understand the value of their existing customers – whether that business is B2C, B2B or B2G – they understand that satisfied customers are more likely to remain loyal, renew contracts, expand services, share positive feedback and recommend them to others.

Successful companies understand the value of their existing customers – whether that business is B2C, B2B or B2G – they understand that satisfied customers are more likely to remain loyal, renew contracts, expand services, share positive feedback and recommend them to others.

This is especially true in the public sector. With large multi-million and even billion-dollar contracts on the line, it’s imperative to have a deep understanding of your customer’s satisfaction level, ensuring that small hiccups do not become larger problems that lead to non-renewal or non-consideration.

How can contractors avoid an unpleasant surprise?

In addition to keeping a close eye on their CPARS ratings, they can access a variety of research tools to help them understand and increase their customer satisfaction. Below are three ideas about what type of research is working:

- Keeping Your Customer: Create a Customer, or Contract, Satisfaction Program

It’s important to get regular, honest feedback from your clients about their satisfaction levels. Measuring customer satisfaction is about more than surveying your clients; it’s about acting immediately on the feedback you get. A customer satisfaction program can help you correct any issues before they become irreparable, and help win the recompete. The key is using third-party research, which is more likely to uncover unbiased information that you can act on. Multiple satisfied customers can add up to a satisfied contract.

Read our client case study: “Importance of Customer Satisfaction Research”

- Understanding and Meeting Your Customer’s Needs: Insights to Support Customer Strategy

Getting needs met — that is perhaps the most basic indicator of a happy customer. Successful contractors do not guess what those needs are; they ask. In fact, through market opportunity assessments, we often find that what the customer needs and wants may not be completely aligned with our client’s expectations. Highly successful contractors use this intelligence to reframe or reposition their offers. The more educated you are about the market you serve, the better equipped you are to respond to customer needs.

- Build Relationships: Become a Trusted Advisor

According to the 2019 Content Marketing Study, public sector audiences, and especially federal audiences are hungry for information from their industry partners. Research reports and white papers were among the top three valuable types of content for federal audiences and data and research to support that content was most valuable feature. To build a stronger relationship with your public sector customer, become a trusted advisor. Highly successful federal contractors invest in research-based thought leadership. This gives them a platform to discuss market trends and establish their expertise while showcasing their understanding of customer concerns and pain points, which ultimately strengthens relationships.

Read a customer Q&A on the value of thought leadership research.

Even the largest of states rarely serve a population one-tenth the size of the entire United States. Similarly, state budgets are a fraction the size and scope of the country as a whole. The overall budget for the U.S. Department of Health and Human Services, alone, rivals that of many mid-size cities. Therefore, it is not surprising that state and local decision-makers do not have the same resources as their federal counterparts when it comes to the procurement of IT products, services and emerging technologies.

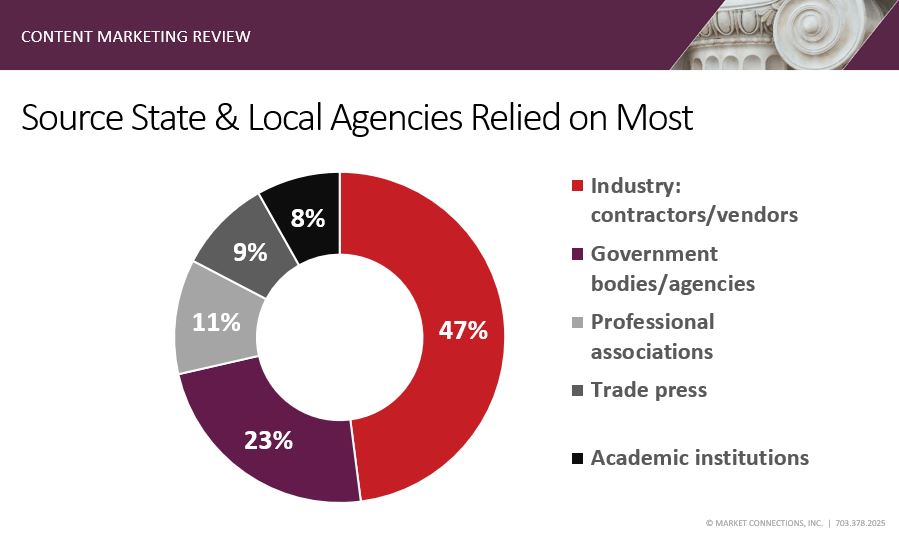

With fewer dollars to spend and fewer people to serve, state and local staffing levels are smaller with greater responsibilities and decisions, laying at the feet of a narrow group of individuals. With fewer colleagues to rely on for research and information, state and local IT decision-makers seek outside resources for education. According to the 2019 Content Marketing Review: Federal & Beyond, nearly half of state and local IT decision-makers admitted the source they relied on the most are industry contractors/vendors (47 percent). They look towards their vendors and suppliers to help them educate, validate and communicate with their stakeholders.

With fewer dollars to spend and fewer people to serve, state and local staffing levels are smaller with greater responsibilities and decisions, laying at the feet of a narrow group of individuals. With fewer colleagues to rely on for research and information, state and local IT decision-makers seek outside resources for education. According to the 2019 Content Marketing Review: Federal & Beyond, nearly half of state and local IT decision-makers admitted the source they relied on the most are industry contractors/vendors (47 percent). They look towards their vendors and suppliers to help them educate, validate and communicate with their stakeholders.

The quote, “with great power, comes great responsibility,” sums up the importance of a vendor’s role for state and local customers. As a vendor serving the state and local market, you have a responsibility to make your content as relevant as possible to these decision-makers. Market Connections’ recent study compared state and local decision-makers with their counterparts at the federal level and identified some key elements that should be incorporated in your state and local government content marketing strategy:

Educate and Explain

State and local buyers are not only thirsty for information, they want it to help explain it in a way both they, and other non-technical colleagues, can understand. Research reports and white papers are the top two ways to get information delivered to state and local audiences whether it’s describing new products, services or emerging technologies. However, over one-quarter also value case studies and marketing collateral, content often rich with descriptions of practical applications, that can explain in clear terms the specifications and benefits of certain products, services and technologies.

While they are thirsting for information, keep in mind how much time you expect them to dedicate to your collateral. While they value written content, the state and local audience is less willing to spend time with this type of content compared to videos and podcasts (only up to 15 minutes with white papers and case studies.) If you are describing something completely new, or very involved and complex, consider webinars, podcasts and videos as long-format content to educate, as the study shows they are willing to spend more time with these content formats (up to 30 minutes or more.)

Validate and Justify

State and local decision-makers are often the sole primary technical consultant within a larger agency of program staff. They need to justify their decisions with materials that clearly explain a certain viewpoint and provide all the background necessary for a clear path forward. Past performance examples and product specifications should be embedded within the description of any service or technology. These informative stories help validate the decision to less technical individuals and justify the vendor selection.

State and local decision-makers are often the sole primary technical consultant within a larger agency of program staff. They need to justify their decisions with materials that clearly explain a certain viewpoint and provide all the background necessary for a clear path forward. Past performance examples and product specifications should be embedded within the description of any service or technology. These informative stories help validate the decision to less technical individuals and justify the vendor selection.

Your content will have legs, so you must treat it as if it will speak to everyone, technical and non-technical. Over half of state and local respondents we surveyed admitted to sharing content electronically with colleagues, supervisors and teams, one-quarter printed it to share with colleagues and one-quarter shared it via LinkedIn or other social media. Among key reasons for sharing included that it confirms their opinion or viewpoint. Too much language that sounds “salesy” in nature is likely to reflect negatively on your customer and not give them the foundation they need.

Final Thoughts

Public sector marketers often need to create content that will serve multiple purposes for this unique audience. First and foremost, this audience is looking at you not only as a vendor, but as a partner helping them support their constituencies. Your content should be short, concise and easy to understand for non-technical audiences, since your target audience may look to use your content to help them educate their colleagues, supervisors and teams and provide validation for their decision to purchase your products and services.

This audience is also open to different ways of content delivery. State and local government customers are more willing than many customers to leverage video and podcasts to help understand the issues and tell their stories. An effective content marketing strategy on the state and local side includes larger doses of video and audio than many of the other traditional public sector verticals.

Learn more about the preferences of state and local audiences or to compare this audience with their federal counterparts, download the 2019 Content Marketing Review: Federal & Beyond full report and infographics.