thoughtleadership

By Susan Rose, Senior Director of Insights & Content

Now that we’re in Q1, content strategies are a big component of planning out the work my team is doing. I noticed that one of the key pieces of a content strategy that I don’t typically see in the plan is how long the various pieces of content will last. Considering how much work we need our content to do for us, this seems important.

Let’s be real: marketing content, in general, is not breaking news. There may be news events that logically tie into the content, but the meat of the content itself typically lasts longer than a few days.

How much longer? That’s the question.

In fact, it’s a question we asked in the Content Marketing Review. The study reaches decision makers across the public sector, and these questions focused specifically on content they rely on during the buying phase of the journey.

The shelf life of public sector content.

We asked respondents how long they use different content types: more or less than six months. Overall, written content types that provide unbiased information are most likely to have a shelf life over six months—case studies, eBooks, white papers, and research reports.

This is good news for those who have incorporated case studies, eBooks, white papers, and research reports into the content plan as they tend to require a larger investment in both time and budget. We’ve seen clients use these pieces for a year or longer. In fact, we use data from our own marketing research studies on average for two years (not all data stays relevant that long, but some does).

Videos, podcast, blogs, and webinars are also an important part of the content mix, although they have a shorter shelf life overall. Even still, there are plenty of people who hang onto that content for some time.

What content should you invest in?

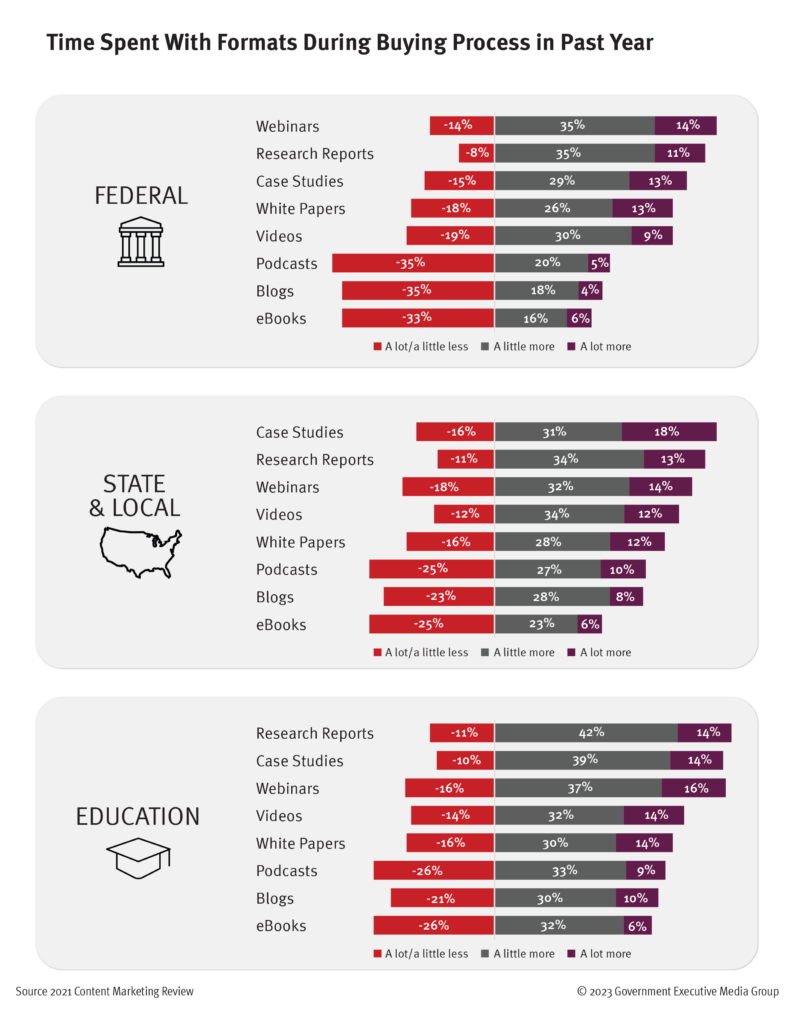

Knowing that the content will be useful for some time, which pieces are best to invest in? Engagement is a key indicator of value, so we asked how much time respondents spent with each content type during the buying process in the previous year.

For all audiences, research reports, webinars, and case studies are the top content during the buying process. Podcasts, eBooks, and blogs are the least used. This doesn’t mean they aren’t important, just that they won’t factor as much into the buying process.

What this means for your content strategy

This data drives home the point that different types of content are best at different stages of the buyer’s journey.

Building awareness? A great blog or webinar will start establishing trust in the brand.

Making the case for a sale? Bring in the research and case studies—the buyers need examples and data to make decisions.

If you need more data on what buyer’s want during their buyer journey, check out our Federal IT Buyer’s Journey study. While it focuses on federal IT, the information is useful across the public sector.

By David Hutchins, Industry Analyst

On October 27, 2022, the Department of Defense (DoD) publicly released the latest National Defense Strategy (NDS). Released every four years, the NDS is subsequent to the President’s National Security Strategy and sets the DoD’s strategic direction and priorities for the next four years. The NDS serves as an important declaration of focus that both US allies and adversaries will closely examine. With an ongoing war in Ukraine, the threat of a new nuclear-armed adversary in the Middle East, and a rising adversary in the Indo-Pacific, Secretary of Defense Lloyd J. Austin III rightly refers to this decade as “turbulent times.” This article unpacks the implications the NDS will have on the defense industry and what this industry can expect in the next four years.

The 2022 NDS lists four top-level defense priorities that the DoD must pursue in order to strengthen deterrence:

- Defending the homeland.

- Deterring strategic attacks against the United States, Allies, and partners.

- Deterring aggression, while being prepared to prevail in conflict when necessary — prioritizing the PRC challenge in the Indo-Pacific region, then the Russia challenge in Europe.

- Building a resilient Joint Force and defense ecosystem.

In addition, the NDS lists three approaches to carrying out the priorities listed above:

- Integrated Deterrence

- Campaigning

- Building Enduring Advantages

Geopolitical Implications:

The previous National Defense Strategy already identified China and Russia as primary adversaries to US National Security, and the 2022 NDS reaffirms that strategic competition with these countries is a top priority. China in particular is viewed as the greatest threat to global order, even as Russia is actively engaged in a war with Ukraine. This means that any entity with an active or planned partnership with either China or Russia will face increased scrutiny in the coming years. Any involvement from Chinese or Russian companies in supply chains may become increasingly difficult or outright illegal. The Countering America’s Adversaries Through Sanctions Act (CAATSA) already penalizes entities for buying or selling military equipment with Russia. If China were to invade Taiwan, these same measures could be extended to any cooperation with China. Moreover, the defense industries of allied countries that choose to partner with Russia or China may find the US to be less tolerant of these actions.

Increased cooperation with existing allies and the formation of a resilient defense ecosystem are also common themes throughout the NDS. The NDS places emphasis on working closely with NATO allies and allies in the Indo-Pacific region, specifically Japan, South Korea, India, Australia, and Taiwan. It’s likely that multi-national production efforts, like the Joint Strike Fighter program, will become more commonplace as the US looks to solidify strategic partnerships while strengthening defense capabilities.

The 2022 NDS also references a need for increased activity in the Arctic region. Warming temperatures have created new corridors of strategic interaction through the arctic that have both created new opportunities and increased competition in the area. For companies with supply lines through the arctic, developments in this region should be closely monitored. In addition, the arctic represents a potential new battleground that would require military equipment and tools that are specially tailored to operate in the extreme cold.

New Arms Race for Emerging Technologies

Of the three approaches outlined in the NDS, the most pertinent to the defense industry is Building Enduring Advantages. This approach can be viewed as somewhat of a new arms race with a focus on emerging technologies that could prove decisively advantageous in a future conflict. The United States and its allies are competing with potential adversaries, such as Russia and China, to develop and refine the latest military technologies and the software that supports them. The NDS points out that these technologies are front of mind for the DoD, stating that the department will “modernize the systems that design and build the Joint Force, with a focus on innovation and rapid adjustment to new strategic demands.” The DoD plans to build enduring advantages by leveraging a “culture of ingenuity” across the defense industrial base, including the many private sector and academic enterprises that work to modernize the Joint Force.

The DoD will seek to acquire technologies that help achieve its five future force priorities — lethality, sustainability, resiliency, survivability, and agility & responsiveness. More specifically, the defense industry can expect increased, or at least continued, investment from the DoD in technologies such as counter-space weapons, directed energy, hypersonics, integrated sensing, drone/UAV technology, robotics, autonomous systems, artificial intelligence, microelectronics, biotechnology, quantum science, and clean energy. The enduring partnership between the DoD, the private sector, and research institutions is vital to developing the latest innovations and ensuring that the United States does not fall behind its adversaries and diminish its technological edge.

Climate Change & Clean Energy

In recent years, the DoD has recognized climate change as a considerable threat that increasingly strains the Joint Force. With this in mind, the NDS places greater emphasis on reducing energy demand, developing clean energy technologies, and building a Joint Force that’s more resilient to climate change.

The concept of a fuel-efficient military using renewable energy sources may have seemed preposterous in past years, yet the concern around climate change has made it a very appealing aspiration. Acknowledging that national security, the defense industry, and the energy industry are all tightly interwoven, the DoD is seeking help from private industry to make advancements in clean energy technology and develop systems that can operate using them. As stated in the NDS, the DoD will “make reducing energy demand a priority, and seek to adopt more efficient and clean-energy technologies that reduce logistics requirements in contested or austere environments.”

The DoD is also partnering with private industry to strengthen the Department’s ability to withstand and recover quickly from climate events. From infrastructure on forward operating bases to the weapons that protect them, all aspects of military operations will need to consider climate resilience as part of the defense ecosystem. According to the NDS, the DoD will integrate climate change into threat assessments, increase the climate resilience of military installations, analyze climate change impacts on the Joint Force, and take climate extremes into account in decisions related to training and equipping the force.

Conclusive Thoughts

The NDS illustrates that US national security faces no shortage of threats. Regardless of whether the next challenge is brought by China, Russia, or a more transboundary threat like a pandemic or climate change, what’s most essential is ensuring that the Department of Defense has the tools needed to respond to those threats. The DoD has long relied on its partnership with the defense industry to develop the innovations that maintain our technological advantage on the battlefield. Although the battlefield may be changing, this concept has not changed. The DoD will continue to count on innovations from private industry to prepare our warfighters for whatever comes next.