federal marketing

Have you ever changed your mind? Not necessarily about something trivial like what you want for dinner, but truly changed your mind about a long-standing opinion of a person, company or issue due to a new experience, discussion or interaction? If you have, you are one of the few. However; as marketers, we ask our target audience to change deep-seated opinions with our marketing and PR efforts.

Why is it so hard to change an entrenched opinion or perception? It isn’t so much about influencing that one person, but more about how much you can influence everyone around them.

The Difficulty of Breaking Convention

A well-known saying can help us illustrate this thought process. “You don’t get fired by hiring IBM.” Substitute “IBM” with any long-standing, high profile vendor in the marketplace. Because the vendor is well-known and established, it benefits from the collective power of the group and the psychological barriers that prevent individuals from stepping out on their own if they disagree. Think about how bold and confident a person needs to be to speak up and present a counter view to an entire group! Even if the argument is well-reasoned and fact-supported, it can be an uphill battle based on the historical assumptions the group maintains (whether justified or not!).

It’s easier to go the conventional path; the risk is spread among everyone in the group.

This sometimes happens when we sit across the table from clients or prospects. The first thing they tell us is they want to influence a specific person in an agency. They assume this ONE PERSON is the key to change, away from the conventional wisdom. They ask us to only interview a specific level of person (often c-suite) and get their opinion. They often forget the environment in which this individual works. Even the most empowered executive faces great organizational inertia to stick with the status quo, or the most well-known solution.

A Better Approach

Wouldn’t it be easier for the executive if opinions were more varied across the organization? Wouldn’t it be better if you knew that when an executive asked for the group’s feedback on a vendor or proposal, there was greater familiarity and awareness of new vendors across all staff, from procurement to technical staff to the program team lead? To change the opinion of your customer, you can’t focus on only the final decision-maker; you need to explore the differences in opinion among all influencers within an organization. We regularly discuss this approach with our clients to help them move the needle.

The influence of the collective is further seen historically across Market Connections’ research. The Federal Media &Marketing Study revealed when making a decision, over half (51%) of federal respondents cite peers and colleagues as the most trusted source of information. What this tells us is public sector decision-makers are just like us. Their decision-making is not just influenced by their own thinking, but the thinking of those they surround themselves with every day.

As you plan your next efforts to understand and influence a specific agency or decision-maker, make sure you understand the thoughts and opinions of the whole ecosystem, and market accordingly.

Learn more about key services Market Connections offers to help you understand how you are perceived in the marketplace and throughout your customer base with brand awareness, customer satisfaction & contract evaluation, new pursuit and capture, and brand, product or message testing.

Over the past year, Market Connections’ signature studies, including the Federal Media & Marketing Study and the Content Marketing Review, have pointed to a rise in the role of professional associations with federal decision makers. These studies, along with additional surveys we have conducted in the federal market, have concluded that public sector marketers should strongly consider working with professional associations to reach federal, state and local decision makers. To further test our hypothesis, we created a PulsePoll™ specifically asking about the role of associations, with the hope that this data can not only support government contractors’ membership and engagement strategies, but also identify opportunities B2G marketers should consider through professional association channels.

We saw the first hint of this trend in the 2018 Federal Media & Marketing Study’s Most Trusted Sources of Information. Two of the top three sources listed among federal respondents for trustworthiness came from professional associations. With nearly half of respondents, professional association websites (46%) came in second place followed by white papers and case studies created by professional associations at number three (36%). Webinars hosted by professional associations also ranked among the top ten, with nearly one-third of respondents listing it as a top trusted source (31%).

We saw the first hint of this trend in the 2018 Federal Media & Marketing Study’s Most Trusted Sources of Information. Two of the top three sources listed among federal respondents for trustworthiness came from professional associations. With nearly half of respondents, professional association websites (46%) came in second place followed by white papers and case studies created by professional associations at number three (36%). Webinars hosted by professional associations also ranked among the top ten, with nearly one-third of respondents listing it as a top trusted source (31%).

We continued to see the importance of professional associations in the 2019 Content Marketing Review: Federal & Beyond. Over half (55%) of federal respondents said they frequently click on and/or download content from familiar professional associations. This is a sharp contrast to the less than one in ten (9%) respondents clicking on or downloading content of unfamiliar vendors.

Recent results from our 2019 Federal Events PulsePoll™ and webinar continued to illustrate our hypothesis of the important role of professional associations in federal marketing. Professional associations ranked second in how individuals learn about events (57%). In addition, among all events listed, those hosted by professional associations AFCEA and AUSA ranked in the top five among all respondents, and even higher among defense agencies.

Looking at these findings alone, one can’t deny the value of working with professional associations to help reach federal audiences, especially for vendors who may not have an existing relationship with target clients.

However, some questions remained unanswered. For example, which professional associations are federal decision makers joining? Should contractors focus their membership and marketing efforts with federal- or IT-focused associations? Are there marked differences in membership by agency type or job role? What factors are important to feds when choosing to join an association? What are some barriers keeping them from joining? Most importantly, how are they engaging with associations that contractors can benefit from?

To help answer these questions, we surveyed federal decision makers about membership and engagement with professional associations. To hear results of our latest PulsePoll™, join our upcoming complimentary webinar: Marketing Through Professional Associations: Reaching Your Government Clients on Thursday, June 27 from 2-2:30 PM EDT.

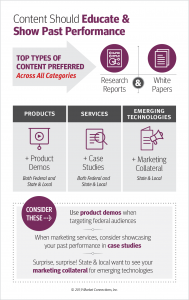

When creating marketing content for a government buyer of products, services or emerging technologies, federal and state and local decision makers want to be educated and not sold to, according to the 2019 Content Marketing Review: Federal & Beyond. Content should help them make informed decisions and have minimal sales messages. Additionally, for state and local decision makers, consider including insight from government thought leaders to help support your message.

Regardless of what you are selling, whether they’re simple products (including laptops, desktops, servers), standard IT services (cloud, cybersecurity) or complex emerging technologies (AI, automation, blockchain), respondents prefer research reports and white papers. Demonstrations are key to those buying products, while those making decisions about services want to hear the success stories through case studies. Finally, don’t underestimate the importance of your marketing collateral, especially among state and local government decision makers. It is certainly a valued piece of content among this audience.

Regardless of what you are selling, whether they’re simple products (including laptops, desktops, servers), standard IT services (cloud, cybersecurity) or complex emerging technologies (AI, automation, blockchain), respondents prefer research reports and white papers. Demonstrations are key to those buying products, while those making decisions about services want to hear the success stories through case studies. Finally, don’t underestimate the importance of your marketing collateral, especially among state and local government decision makers. It is certainly a valued piece of content among this audience.

Education is best done through providing the detailed information and specifications needed by decision makers ranging from the highly technical process specialists to the more outcomes-based managers. Federal, state and local decision makers all wanted the content they consume to contain research and data to support the performance claims, examples of past performance by vendors, and the detailed specifications necessary to make the products or services work within their agencies.

A unique difference between state and local audiences versus federal audiences is their desire to see insights from thought leaders. State and local respondents cited wanting to see insight from government thought leaders, likely given the fact that they do not have the same type of infrastructure in place for information sharing that exists on the national level. In addition, many state and local technology buyers are part of very small staffs and departments and relish outside input. Federal decision makers, are more likely to want insights from industry thought leaders, perhaps looking for ideas and perspectives that are not deeply rooted in just a public sector world.

It is important to note and reinforce that at least one in five respondents mention they prefer content without sales messages. Federal respondents are more willing to accept sales messages within blogs, while state and local tolerated them more in videos and case studies.

Whether your focus is on the federal or the state and local market, as a marketer looking to reach and engage your target, you must create content that educates above all else. Across the board, make sure your content has the data and research needed to support your assertions, contains information about past performance (including customer testimonials and insight from your customer’s peers) and specific details about your product or service that will help inform their decision or help them justify it to their stakeholders.

See full results from the 2019 Content Marketing Review: Federal & Beyond here.

Additional blogs on best public sector marketing practices based on this year’s results:

- Content Marketing: Be a Partner to Your State & Local Customers

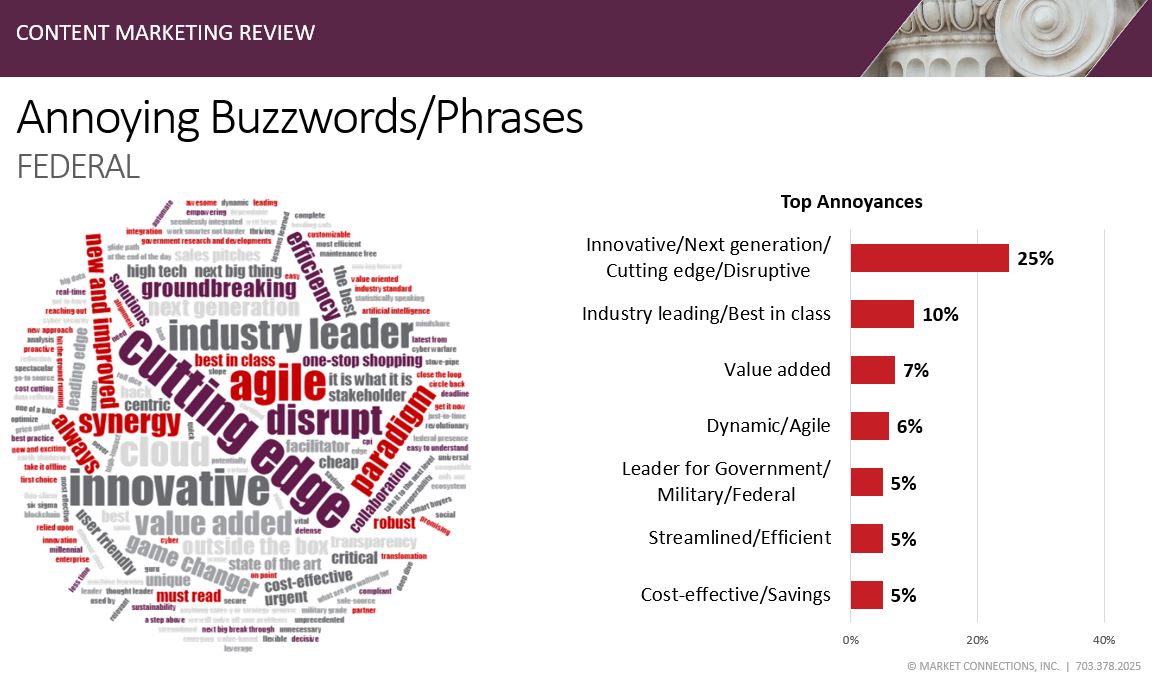

- Don’t Let Buzzwords Kill Content Directed at Your Federal Audiences

“Our company provides innovative, cutting-edge services meant to disrupt the existing paradigm through best-in class products, agile, game-changing industry leaders and a one-stop, value added portal.”

If “Buzzword Bingo” were a game, this sentence would have hit all the squares on the bingo card!

From the 2019 Content Marketing Review: Federal & Beyond

Writing a description of how your product, service or even your company, is different than your competitors can be difficult for B2G marketers. Commonly used words like innovative, cutting edge and next generation, have lost their impact and can ring hollow to customers. While marketers often get requests to use these words in their materials, can including these words in marketing content hurt a brand, rather than help it? According to the Market Connections’ 2019 Content Marketing Review: Federal & Beyond study, certain words and phrases may annoy readers more than they explain what you do. In addition, as we have shown in our recent webinar, Differentiation in a Federal Market: How Do You Stand Out?, leaning heavily into these phrases does not necessarily aid in the overall differentiation of your company in a crowded, evolving marketplace. Our in-house database of digital marketing collateral from 100 top technology contractors contains millions of words and highlights the similarities between what is being promised from vendor to vendor.

Content aimed towards government IT customers, whether a white paper, marketing collateral, or a white board-style video, should be built upon three pillars: data and research; product specifications; and past performance. While it may be difficult to avoid all buzzwords, your content should focus on including these three pillars to ensure you keep your customer engaged. Federal, state and local technology decision makers want direct and informative content without the jargon to avoid the overt feeling they are being sold a bill of goods.

Finally, make sure your content includes clear statements focused on the value of your product or service to the organization, in non-technical terms customers can circulate. Three-quarters of federal respondents and over half of state and local respondents admitted to sharing content electronically with colleagues, teams and supervisors, many of whom may not have the same technical expertise as your initial target and may be even less tolerant of buzzwords.

Throughout our review of feedback from federal, state and local IT decision makers, we consistently came back to the theme that content should educate. Education is about presenting the right information at the right time using language that can be understood by the audience. By ensuring that you are meeting the expectations and needs of your audience and avoiding buzzwords and phrases, you are one step closer to creating content that meets your prospect’s needs, and, in turn, advances your company throughout the sales process.

To get the full list of top “annoying buzzwords” for both federal and state and local audiences, contact us at mcanizales@govexec.com.

Learn more about content preferences of federal, state and local IT decision makers by downloading the full report and infographics of the 2019 Content Marketing Review: Federal & Beyond.

Watch the recording and download slides for our webinar: Differentiation in a Federal Market: How Do You Stand Out?