marketing plan

Exclusive Information Session and Networking Event Happening on 6/29

With the plethora of information sources available at our fingertips, sifting through and narrowing down the data required to map out effective marketing plans and strategies can take considerable time and effort. We want to help.

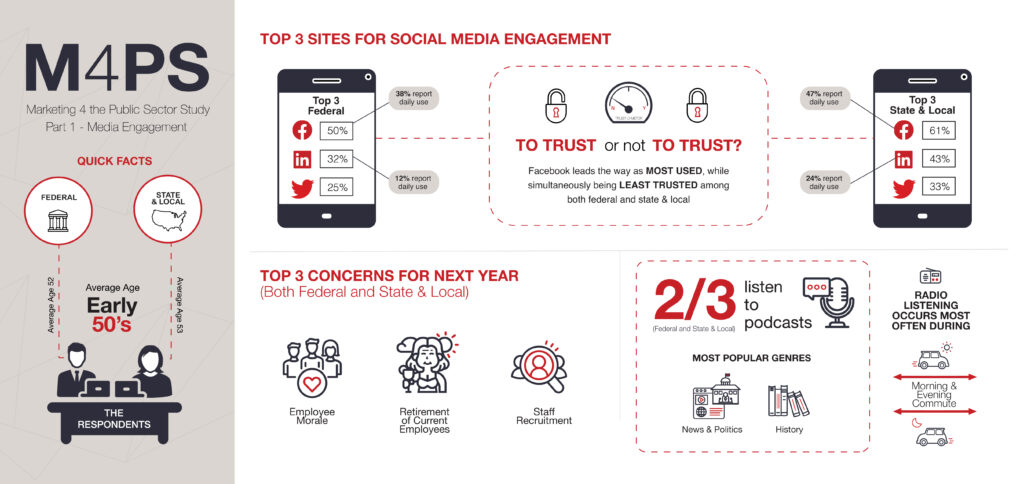

Formerly brought to you under a different title, Content Marketing Review, the spring iteration of our two part Marketing for the Public Sector (M4PS) study answers questions like when, where, and how the public sector prefers to receive information about products and services. For example:

- One third of respondents use LinkedIn for news related to their job vertical.

- The favorite format for job-related information and education is explainer videos.

- Well prepared presenters make for memorable webinars.

Launching on June 29th, 2023 at an exclusive networking event (happening in Tysons, VA), a panel of industry experts will dive into the current outlook regarding participation in in-person/virtual events and media/content format preferences.

Here are five reasons YOU should consider attending:

- 1) In-person networking opportunity.

- 2) Pertinent, actionable information for marketing plans/strategies.

- 3) Insights into public sector audience content preferences.

- 4) Types of content respondents prefer throughout the buying process.

- 5) High quality research you can act on.

Whether you are interested in a broad awareness campaign or a more focused agency-based marketing effort, this information session will help you measure the preferences of your public sector audiences.

Event details

The M4PS Content Marketing breakfast will be held on June 29th at The Archer Hotel in Tysons, VA from 8:00AM-11:00AM. Register today and join us for breakfast, in-person networking and an informational presentation by a group of industry experts.

Early bird pricing available until 6/12.

When it comes to reaching public sector audiences there are a number of things to try, a number of avenues to venture down, and a number of platforms to spread your message on. If you’re reading this, you’re already aware of that.

Yet, with the plethora of information sources at our fingertips, it can be hard to narrow down the specific data needed to begin formulating marketing plans and strategies. That is why the Market Connections research team created a study specifically for the individuals and teams Marketing for the Public Sector (M4PS).

Part one of the study launched in October 2022 and provides insight into media engagement habits. Part two, slated to launch in June 2023, will get more specific, diving into the procurement and buying processes, current outlook regarding participation in in-person/virtual events, as well as media/content format preferences.

Overview

We surveyed more than 1,000 people working in the federal and state/local government about their media engagement habits. We asked them about:

- Top concerns for the next year

- How much trust do they have in the information they get from certain sources

- How much time is spent on an average workday accessing certain media

- Top digital sites for getting news/information

- Confidence in news sources

- Social media usage

- Top sites for streaming

- Data/information on podcast listenership

Included are key insights, observations and takeaways from analysts – as well as specific data on the DMV market (D.C. Maryland, and Virginia region.) Whether you are interested in a broad awareness campaign, or a more focused agency-based marketing effort, our aim with part one of the M4PS report is to provide you with trusted data, ultimately serving as launching point for your future planning endeavors.

What is important to your audience

Figuring out what’s important to your audiences is key. It allows you to make decisions with a wider lens or narrow down and go niche if necessary.

By arming yourself with both parts of this report you will be able to further strategically position yourself exactly where you want to be in the public sector market. Since all goals are different and there is no one-size-fits-all approach to planning, we started here by anticipating your needs, so you can in turn begin to anticipate the needs of your audiences.

The media engagement report is available now.

And keep an eye and ear out for M4PS part two, coming in June 2023.

Have questions? Want more information? Please reach out to info@marketconnectionsinc.com.

Marketing 4 the Public Sector Study - Part 1

Full report available Friday December 9th, 2022

ABOUT THE STUDY

The Marketing for the Public Sector report represents the views of thousands of federal and state/local employees in a variety of positions.

Focusing on engagement within the digital landscape, this study is meant to empower marketers with the knowledge they need to perfect their marketing plans, campaigns, and content.

Created in an easily digestible and navigable format, the report presents pertinent information about audiences’ media engagement habits across broadcast, social, and digital sources.

Whether you are interested in a broad awareness campaign or a more focused agency-based marketing effort, we want to give you the valuable, trusted data and insights on the media and engagement habits of those tough-to-reach federal and state/local audiences.

WHAT TO EXPECT

- Full Report – Contains data and insights on both federal and state/local customers

- Topics Covered – Demographics, job functions, trust in media sources/social media websites, confidence in news (among others)

- Publications & Digital Sites – Government media, business and news media, technology & industry, social media & lifestyle

- Key Insight – Top concerns for next year, time spent listening to news/radio, accessing social/news media on an average workday, most trusted social media sites

Visual infographic:

What is custom content and why does it need to be part of your 2023 marketing plan?

by Susan Rose, Senior Director of Insights and Content

As part of a company that produces every type of content, we find “content” means different things to different people, and some new definition pops up every single day. This can make determining the right content mix to meet your business goals a bit of a challenge.

At GovExec, we talk about editorial content, sales content, and custom content. All types of content are an important part of a marketing strategy. Deciding which one to use in any given situation depends on what your expectations and needs are.

Fortunately, we have some research to help you figure that one out as you start working on your 2023 marketing plan. But first, what is custom content?

What custom content is NOT

It is important to know what it is NOT before diving into what it is. Custom content is neither editorial nor sales content.

Editorial content is designed to inform or entertain. It is what we call “newsworthy” because it tends to be about something happening in the moment, like coverage of a vote in Congress or the war in Ukraine. Editorial content is about what is happening on the ground.

Sales content, on the other hand, is created for the explicit purpose of generating sales. That means it will talk about how a specific product or a specific service is going to work for a public sector agency: what it’s going to do and why the client needs to purchase it. It will not be a broader discussion about the technology; it’s going to be about something very tangible.

Since that seems like the majority of content you see daily, what is custom content then?

What Custom Content is

Custom content is the practice of marketing via content a business funds or sponsors. Editorial content does not have any sponsor and sales content is all sponsor.

When a company underwrites a custom content piece, we work with them to determine the topic and what the audience needs to know or learn. Custom content is relevant and valuable to the audience, and as such helps build trust.

In general, custom content will be based on research. We will dig into studies and reports, or look at industry wide trends. The result will be an unbiased story about what the data means. This content relies on the knowledge of subject matter experts as well as reputable research sources.

Custom content includes native articles, research reports, webinars, podcasts, and videos. When you see something on our GovExec properties that says “sponsored by,” that means it is custom content and a company paid to create it. They helped determine the topic and the educational focus. They have NOT determined what we say because if the research doesn’t back up a specific point of view, we are not going to publish it. Our reputation is on the line. Custom content simply means the company had some influence in topic and direction, and therefore the piece is not pure editorial.

Why do you need to add Custom Content to your 2023 marketing plan?

Custom content is about building that trusted adviser relationship that your team wants to have with your public sector customers. Everything we do is geared toward that.

Why is this so important?

Glad you asked.

Market Connections conducts a variety of studies that look at public sector marketing and trends. Data from our three most recent studies come to the same conclusion: custom content resonates with your audience.

That is ultimately why you need to use it.

In the Market Connections Content Marketing Review, we asked public sector decision makers what kind of content they find most valuable overall. What this data shows is that the public sector values a range of content types.

When we remove editorial and sales content from the mix, you’ll see that custom content types are valuable to the audience—particularly fed and sled audiences.

A little background: We chose 14 different content types because these are all part of the public sector marketing mix.

The figure shows that overall, the public sector audience finds all of them valuable, and therefore are all a really good part of your content mix. Remember that.

But what this also shows is that when you remove editorial and sales content from the mix (which is what we’ve covered up) is that of the 14 content types, 10 are custom content.

Research Reports are highly regarded as valuable content, followed by white papers, and articles. Does that mean you need to spend all of your budget on research? Not necessarily. It depends on your budget and your annual goals. And while your audience really likes reports and white papers, you’ll notice that webinars still have a very high percentage of value to the audience.

What does a custom content mix look like in action?

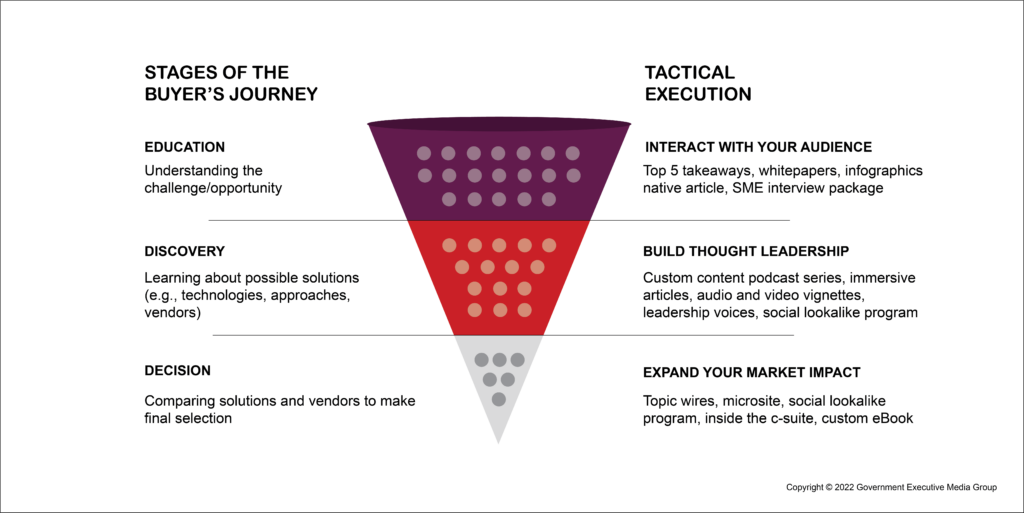

That’s a great question that only you can answer based on your marketing budget, initiatives, and company goals. This figure of the buyer’s journey illustrates where various types of content have impact along the journey. It’s important to address the audience at the various stages of the journey.

We suggest a mix of ebooks, webinars, articles, video, podcast, white papers, and so on–really anything from the list in the figure.

What we definitely suggest is getting the most out of the content you create. Repurpose, repurpose, repurpose.

Say you commission some custom research, you can get a research report, a white paper, a few articles, a webinar, a podcast, and more out of it. That will give you the most bang for your marketing dollar.

Need some help? Contact your GovExec sales rep to discuss a program to fit your needs. Or, contact me–I love talking content strategy! (srose@govexec.com)

Aaron Heffron, President, Market Connections

From the Desk of Aaron Heffron, President, Market Connections, Inc.

As we fully engage into our 2021 marketing and sales plans, it’s important to know, “are we exploring or expanding?” As we have written about in the past, many areas in the public sector market have reached a certain level of maturity. Many companies now find themselves firmly entrenched in delivering services and products to federal, state, or local agencies. These contracts—years in the making and with returns on investment continuing for the next 3-5 years—can provide a sense of security for any business. As a marketer, at this point, what is your next step? Will you be an explorer or an expander?

Explorers that we read about in textbooks or learn through stories told across generations are often driven by the need to see places they’ve never seen and find things that have never been found. In business this is reflected in companies that develop new products and reach out to markets they have never touched before. New markets are higher risk, but the potential rewards are great.

Expanders are people, and companies, who deepen their roots and influence in their local communities, or grow their relationships with their current customers. These relationships secure businesses for the long term and create new connections among the same people, establishing bonds that are harder to break.

As a marketer supporting sales, product and operation, the information you need to make a sound decision is different when you support an explorer versus an expander.

Recent polling of the federal workforce highlights some of the challenges facing markets, who must develop the messaging and channel to best connect with current and potential customers.

- When seven out of ten federal workers report that they are likely to be working outside of normal business hours because of COVID and telework issues [check out our webinar] you have an opportunity to expand your connection with you customers by supporting them wherever and whenever they need it.

- The same number of federal buyers trust the information [see report] from vendors as those who distrust them – a foreboding landscape for any marketing and collateral material. What’s your plan to build trust as you explore?

- Nearly 20% of federal workers are questioning whether they will ever attend large trade shows and events again. How can you expand your relationships with individuals you can’t meet face-to-face in the near future, or ever?

- With commute times dropping as individuals look to a future of blended remote and in person work, how can you support your explorers and make your company known in other ways to those markets that have never heard of you?

Whether your goal is expansion, exploration, or a little of both, investing in data and information on your current or potential customers can help you leverage your limited budget for maximum impact. You would never set out on a new adventure without a map or detailed recognizance. (Remember that time you “thought” that was the right turn?) Your sales teams would never walk into a customer meeting with the presumption they always know what the customer needs. We live in an information age. An investment in information is worthwhile for those boldly going forth into new territories or those treading carefully in familiar territory.