B2G marketing

By Jonathan Sanders, Director, Research, GovExec

The White House has announced its plans to introduce an executive order in the near-future focusing on AI.

With remarks from President Biden from the September 27, 2023 meeting with the President’s Council of Advisors on Science and Technology, he notes he has “a keen interest in AI and convened key experts on how to harness the power of artificial intelligence for good while protecting people from the profound risk it also presents.”

Furthermore, he notes the collaborative efforts made to achieve this vision with world leaders and American technology companies to help set the stage for responsible AI innovation. Fifteen companies have now announced their voluntary commitment to the White House to support safe, secure, and trustworthy development of AI.

Arati Prabhakar, the director of the White House’s Office of Science and Technology Policy, noted regarding the forthcoming AI EO, “It’ll be broad. It really reflects everything that the president sees as possible under existing law to get better at managing risks and using the technology.”

Prabhakar and the White House have both noted the ongoing goal of taking a values-led approach to AI usage and development, building on the AI Bill of Rights released in October 2022.

Biden did not release any concrete details on the upcoming order. Prabhakar noted that a draft bill has already been created to benefit both federal efforts and industry research, and that “we want to seize the great power that this technology has to solve some of our hardest problems”.

President Biden is expected to deliver this executive order this Fall.

What does this mean for you?

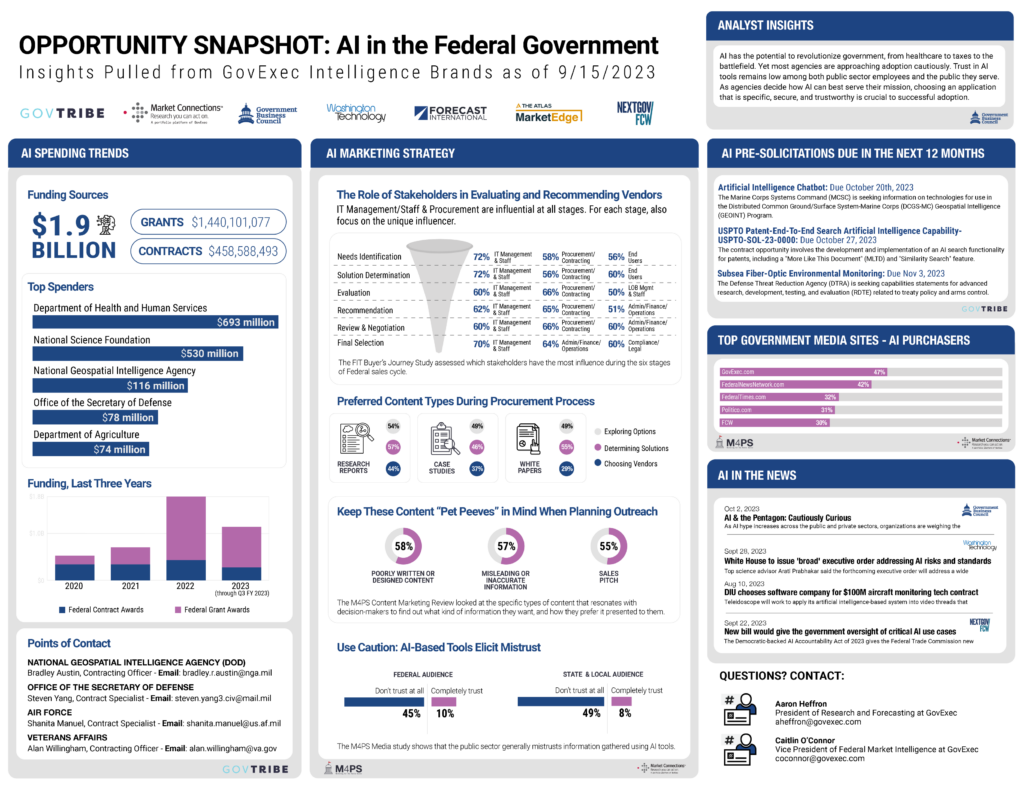

As AI continues to be the topic of discussion across Government, Industry, and academia, keeping abreast of opportunities and policy changes is critical.

Get the joint GBC/GovTribe report on the current AI landscape in the federal government (information current as of September 15, 2023).

The on-demand recording of the Spring 2023 M4PS Content Marketing Review is available for purchase now.

This study gets to the ”why” and the “what” of your B2G marketing strategy to help you make choices that align with your company’s broader goals and budget needs. We are a partner in helping you achieve maximum results.

This on-demand workshop will give you the insights and information you need to go into FY24 primed for success. You will have access to:

- Four panel discussions among industry peers sharing their experiences and perspectives on marketing the buyer’s journey, creating impactful contents, hosting events (in person and online), and how to do all of that on a budget.

- The full report containing all of the data: content preferences, types of information the audience wants… and when, must-dos for events, and more.

- A one-page graphic with the data highlights to keep top of mind as you implement your plans.

On Thursday, June 29th, 2023, Market Connections hosted the Content Marketing Review, part of the Marketing for the Public Sector (M4PS) studies. It wasn’t just about the delicious breakfast and networking with a room full of extremely knowledgeable and talented marketers specializing in the federal, state, and local markets. It was about actionable data that will help every public sector marketer plan their marketing strategies. Aaron Heffron, President of Research and Forecasting at GovExec, moderated the event.

If you missed the live event, the on-demand recordings and resources are available now.

You can find them here >>> https://events.govexec.com/m4ps/

Content Market Review: The Recap

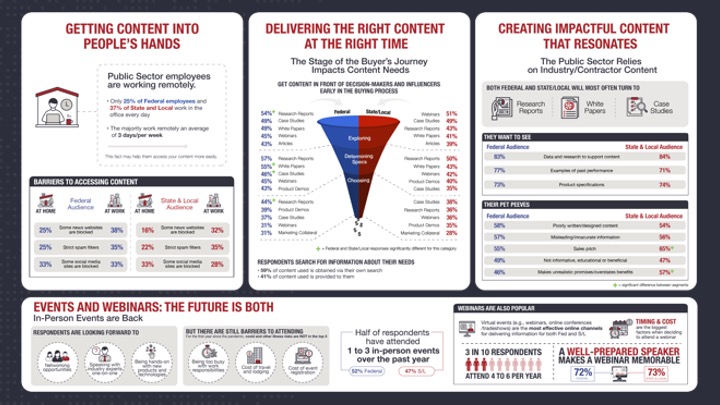

Industry experts led each session, sharing key findings from the Content Marketing Review. The data covered content marketing tactics, the current outlook regarding in-person/virtual events, media/content format preferences, content shelf life, and insight into the challenges marketers face.

Industry experts led each session, sharing key findings from the Content Marketing Review. The data covered content marketing tactics, the current outlook regarding in-person/virtual events, media/content format preferences, content shelf life, and insight into the challenges marketers face.

Discussions revolved around how it’s possible to provide tangible, insightful, and data-driven content throughout all levels of the funnel while combating staffing and time challenges, as well as budget constraints. Common themes emerged, and the data addressed them: What do decision-makers need? What are they looking for? What is it that they want to get out of the content? What do they need to know and what makes it effective?

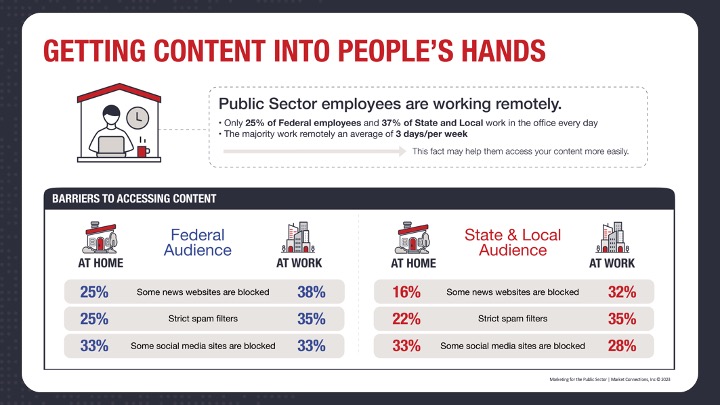

Over the past two-to-three years government employees were working one hundred percent remotely. Currently, federal employees spend roughly half of their work week in the office and the other half working from home (state and local are predominantly back in the office). Where the employees are working, whether at home or in the office, can dictate how to best reach them and channel creative content. It is essential to make sure the relevancy of the content connects to the right person, at the right time, on the right platform.

We split the M4PS Content Marketing Review into four panels where industry experts shared their results and then discussed them with respect to the work they are doing now. If you are interested in some high-level key takeaways resulting from this event, read them here.

Speakers: Anna Pettyjohn, Senior Vice President of Marketing, GovExec and Lisa Sherwin Wulf, Founder and Marketing Consultant, LSW Marketing.

Speakers: Susan Rose, Senior Director of Insights and Content, GovExec and Camille Tuutti, CEO and Founder of Tuutti Frutti Strategies.

Speakers: Travis Wolfe, Director of Event Operations and Business Development, GovExec and Stephen Ellis, Director of Public Sector Marketing, Palo Alto Networks

Speakers: Susan Rose, Senior Director of Insights and Content, GovExec and Monica Mayk, Head of Marketing, U.S. Public Services, Tata Consultancy Services

P.S. Purchase the On-Demand package now

B2G marketers: this article is part 4 of a 4-part series recapping the June 2023 Content Marketing Review.

B2G Marketing on a budget… we’ve all been there. Most of us live there permanently. At the Content Marketing Review, Susan Rose, Senior Director of Insights and Content, GovExec and Monica Mayk, Head of Marketing, U.S. Public Services, Tata Consultancy Services talked about marketing on a budget. Part 1 of this series answered the question, “If it was a perfect world and you had everything that you wanted, what would your marketing strategy look like?”

This panel answered: “Okay, we don’t have unlimited time, staffing or budget. How do we make all of this work?”

This panel answered: “Okay, we don’t have unlimited time, staffing or budget. How do we make all of this work?”

Investing More Money Into Marketing

A lot of people are wondering, “How can I implement a strategy when I have a micro budget? How do I work with a budget that’s tactical and get the results in return that superiors are wanting?”

Tight budgets are real. Yet senior leadership needs to understand that if they are not making a sufficient investment in marketing, the marketing units can’t be strategic or deliver the type of results they are looking for.

It is key for companies to set aside a certain amount of money for marketing so marketers can establish a reliable strategy that will result in their connected presence in the market. For example, when Monica worked with Verizon, she was on a shoestring budget. She only had a few hundred thousand dollars to support a two billion dollar business that was trying to sell into every federal agency. A few hundred thousand dollars wasn’t nearly enough to manage the vastness of the business, so she had to use that investment in creative ways to incur a reasonable outcome (listen to the on-demand recording to learn what she did).

Knowing the Portfolio is Key to B2G Marketing on a Budget

Knowing everything your company is selling under your portfolio is important in establishing a logical strategy. Referring back to Monica’s Verizon example, she had a gigantic portfolio and had little idea about some of the products and services that her company was selling. And she had to market solutions that people did not associate with the company’s brand. In fact, she almost had to work against the corporate and consumer brand by focusing solely on her priority, which at the time happened to be all of the federal agencies.

She established a process where she said, “let’s find the intersection between what we have to offer, what’s important to our customers, and who are the places we are selling to” so her company could establish some thought leadership and demonstrate some expertise. Through this process, she was able to narrow down the portfolio and pick a few key solutions that would connect to their customers and prospects. Security, connectivity and public safety were those initial priorities at the time. This process allowed Verizon to showcase key solutions and products that supported those specific themes that resonated with the agencies. By following this process, Verizon went from having no impact on the agencies to making their presence abundantly clear in the market.

Marketing Strategies

Conducting research and leveraging credible data that has been validated will always increase the trust the market has in you. Thought leadership and content campaigns, as well as advertising and awareness aspects, all aid in getting your message out there. A few B2G marketing methods that tend to be successful when you’re on a budget are:

- Articles

- White Papers

- Research Reports

- Advertising Messaging

Finding the right partner that will help you create, publish, promote, extend, and reuse content will end up being a high-value investment, because you are essentially receiving five things for the price of one. It is not only important to broadcast your content on your own website and LinkedIn account, but third party websites as well. Posting content on other sites increases your chance of reaching a larger audience.

Final Thoughts

It is important to note that marketing results will be measured over time. You cannot expect to garner results right away. That is one of the hardest things that finance teams cannot understand in the public sector. You have to wait three-to-five years before you start seeing practical results. As a prime example, Monica spent around a million dollars in marketing with Verizon over the course of three years on a single opportunity with one agency. After a five-year pursuit, Verizon won an agency single source contract for $2.3 billion dollars. A million dollar investment ended up turning into a $2.3 billion dollar, ten-year contract. This is just one of the many examples that proves if you invest a considerable amount toward your marketing budget then you can end up with an astonishing end result.

Get the Study

Want more? The Content Marketing Review is now available on demand. Click this link to learn more.

Related Posts

Marketing 4 the Public Sector (M4PS) Study Recap

Marketing The Funnel and Delivering the Right Content at the Right Time

Creating Impactful B2G Content

Events and Webinars: where we are, where we’re going

Federal SLED and Marketing on a Budget

B2G marketers: this article is part 3 of a 4-part series recapping the June 2023 Content Marketing Review.

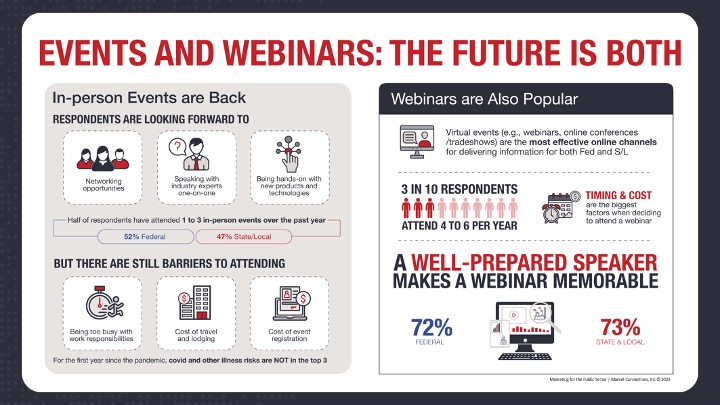

Public Sector events are traditionally a high-value tactic. Is that still true? Travis Wolfe, Director of Event Operations and Business Development at GovExec and Stephen Ellis, Director of Public Sector Marketing at Palo Alto Networks spoke about events and webinars. Travis coordinates GovExec events and has been a part of the resurrection of in-person events. Stephen has vast experience running and investing in different types of events.

Both agree it is no secret B2G marketers have been rolling the dice a little bit when it comes to events, asking themselves:

Both agree it is no secret B2G marketers have been rolling the dice a little bit when it comes to events, asking themselves:

- Are we going to get the ROI on these events?

- Are people actually going to show up?

- Does making an event hybrid impact in-person attendance?

Travis noted many of us are in a weird gray zone from pre-COVID to post-COVID and are trying to decide where to go from here. This is what the research says…

In-Person Public Sector Events

The data shows that in-person events are coming back. Travis has personally witnessed this from the number of sponsors and vendors asking him to host live events.

However, only about 30-45% that register for your event will actually show up; therefore, finding creative ways to showcase your content is important to secure your audience. You want to make sure you are initially sharing engaging content, whether it be featured speakers or big conversational topics, to pique your audience’s interest. You also want to ensure that there are interactions with experts. The expert one-on-ones and hands-on moments with products and technology are what motivates people to get out of their homes and to your events. Although we are seeing an increase in the amount of live events being held, there are still barriers to getting attendees to your events. A lot of employees are still working hybrid or remotely so you want to make sure that you are making it worthwhile for them to leave their homes, commute, and incur traveling/event ticket costs to attend your event.

Public Sector Webinars

Webinars continue to be popular: approximately 75% of respondents attended four or more in the last year. Webinar attendees are typically interested in more technical information, fireside chats, and flashy presentations that don’t necessarily work at an in-person event. Using compelling visuals can really make your webinar stand out amongst the sea of others.

Webinars eliminate many of the issues we’re seeing with in-person events, particularly travel costs. There are often registration costs associated with webinars, but the biggest takeaway is that attendees like the fact they do not need to leave the office to attend an event.

Final Thoughts: Public Sector Events are Back

Both in-person events and webinars have their own set of challenges. Preparing, creating innovative processes, and maintaining creativity throughout the entire process is key. You initially need to know:

- What is the ultimate goal?

- Who is your intended audience?

- What type of content would you like to resonate with your audience?

Once you know the basics, then you can choose the type of event that best aligns with your vision and begin targeting your audience. The most common channels through which to share event marketing details are social media and email blasts.

We have seen an uptick in the amount of people who are registering for events, not showing up, and then requesting the content that was shared at the event. It is important to keep in mind that if you share every detail that was discussed at an in-person event, people will never attend your event. You can share key takeaways and highlights but do not provide them with every piece of information unless you put it on demand and charge an extra fee.

At the end of the day, you want to increase the number of attendees, so being strategic in your approach of sharing information post event is vital.

Watch the replay

Want more? The Content Marketing Review is now available on demand. Click this link to learn more.

Related Posts

Marketing 4 the Public Sector (M4PS) Study Recap

Marketing The Funnel and Delivering the Right Content at the Right Time

Creating Impactful B2G Content

Events and Webinars: where we are, where we’re going

Federal SLED and Marketing on a Budget

B2G content marketers: this article is part 2 of a 4-part series recapping the June 2023 Content Marketing Review.

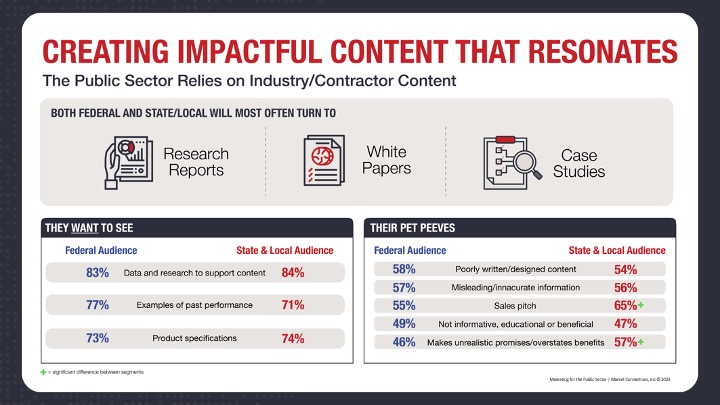

Content is King. But it’s only an effective ruler if it resonates with the audience. B2G content marketing experts Susan Rose, Senior Director of Insights and Content, GovExec and Camille Tuutti, CEO and Founder of Tuutti Frutti Strategies discussed what that looks like when marketing to the public sector.

The Exploring Phase of the Buyer’s Journey

When the public sector is in the exploring phase, they are most interested in hearing from government sources. Specifically, they want to know how the government is innovating, what’s working, and what successes have they seen.

When the public sector is in the exploring phase, they are most interested in hearing from government sources. Specifically, they want to know how the government is innovating, what’s working, and what successes have they seen.

That said, they are also interested in the industry perspective. The main content sources that resonate during this phase are research reports, white papers, and case studies because they are generally unbiased. At this stage, they are not ready for the sales pitch or product specifications. They prefer to find the content and educate themselves before they talk to you about what you can offer. They don’t want any unsubstantiated claims: They want data and research that supports what you’re saying. Therefore, it’s important that you include data and research within white papers, research reports, etc.

That means keeping your B2G content honest and truthful to ensure it resonates and passes that first “sniff test.” As you are creating your content, utilize storytelling. Camille made a great point about how success stories always sell, but you’re not selling. You’re not in their faces saying “Oh we are the leading provider and this is why you should buy our product.” When creating content, it is also important to know your audience’s pain points. By understanding their pain points, you can create relevant content and compelling messages. Relatable content and messages will attract people and ultimately result in a conversion of leads.

Repurposing B2G Content

Creating impactful B2G content is an investment in time, but once done it can have a long shelf life. Invest in a great cornerstone piece of content that’s targeted to a specific person, and then repurpose the piece for other audiences. You don’t necessarily have to start from scratch, but you can adjust the original piece and turn it into different kinds of content depending on what the person is interested in. There are a plethora of ways that you can repurpose prior work and/or content. Say you had an interesting podcast where a lot of data insights were disclosed, you could use those stats and incorporate them into a blog post or share them on social media or create an infographic. The most important thing to know is where your audience finds their information and then pick a channel from there.

ChatGPT?

ChatGPT had not yet exploded when this survey was fielded, but that didn’t stop Susan and Camille from touching on it. They agree that ChatGPT is a good starting point when creating content, but do not rely on it 100%. There are many ways to use ChatGPT so the content resonates with your audience.

- Translate Technical Language – Say you had a call with an SME who explained technicalities in a very dry language. You could use the tool to translate or explain what was said in a conversational tone.

- Editor – If you do not have a good editor on your team, ChatGPT can fill that void by checking for errors, filler words, repeated words, etc.

- Ideas – When creating content for multiple people at the same time, writer’s block can set in. ChatGPT can assist with unblocking your mind by giving you a bunch of ideas, examples, and material to start with. The AI tool can be used to flush out some of your ideas or give you new ones.

Watch the replay

Want more? The Content Marketing Review is now available on demand. Click here to learn more.

Read More

Marketing 4 the Public Sector (M4PS) Study Recap

Marketing The Funnel and Delivering the Right Content at the Right Time

Creating Impactful B2G Content

Events and Webinars: where we are, where we’re going

Federal SLED and Marketing on a Budget

B2G marketers: this article is part 1 of a 4-part series recapping the June 2023 Content Marketing Review.

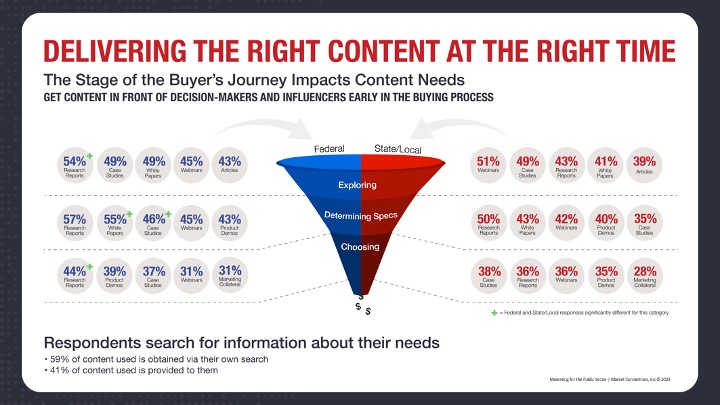

At the Content Marketing Review, B2G marketing experts Anna Pettyjohn, Senior Vice President of Marketing, GovExec and Lisa Sherwin Wulf, Founder and Marketing Consultant, LSW Marketing spoke about marketing the funnel and delivering the right content at the right time. Their conversation centered on their experiences and knowledge when it comes to B2G content marketing and emphasized the importance of needing time, a larger budget, and resources to aid in successfully executing on all strategies.

At the Content Marketing Review, B2G marketing experts Anna Pettyjohn, Senior Vice President of Marketing, GovExec and Lisa Sherwin Wulf, Founder and Marketing Consultant, LSW Marketing spoke about marketing the funnel and delivering the right content at the right time. Their conversation centered on their experiences and knowledge when it comes to B2G content marketing and emphasized the importance of needing time, a larger budget, and resources to aid in successfully executing on all strategies.

For the full study results and key takeaways, see the On-Demand presentation.

The Challenges We all Face

B2G marketers have two challenges in common, and Lisa and Anna shared how they handle them:

- Budget, Resources, and Time: You have to be realistic. You have to take a look at what resources you possess. What’s your budget? Do you have SMEs? Do you have enough people to create the content? What kind of traffic do you already have? How can you execute? Do you have customers that are willing to speak? It always comes down to your budget, resources, and time.

- Getting Everyone On The Same Page: Another big challenge is your sales team. You want your pitch to resonate with your customers, and that means giving them the information they want and need. Creating a tangible roadmap for milestones so everyone is on the same page can be an effective way to ensure initial priorities are still being met.

In a Perfect B2G Marketing World…

Lisa said that in a dream world, once you have your budget, resources, partners, and vendors established, you would next want to know the foundational concepts. For example:

- What are your business goals?

- Do you have documented messaging that’s adjusted for the public sector as needed?

- Do you have campaign themes defined?

- Do you have SMEs?

Having the time and budget allows for creativity within the foundational process. After you’ve understood the overall foundation, then you want to get an idea of the inventory of existing assets. Even with an unlimited budget and time, you still want to look at what you are trying to convey.

- What are your customers going to learn?

- How do they want to learn?

- What are your themes?

You may get lucky and things may already exist that you could reuse. Last but not least, in this perfect world, you’d have an SEO team, designers, a video team, and intent data and email nurturing to help share relevant content.

Making sure your content finds the audience

The biggest takeaway from this panel is that whether someone is working from home, working in the office, or traveling, providing content throughout all stages of the funnel is critical.

Webinars, research, white papers, and search engines resonate across the different stages of the funnel, but the specific focus and information will change.

If you do not have an SEO team, it is essential to look at how your audience can discover your content and ask the following questions.

- How are you promoting on social media?

- Do you have the budget for paid search?

- Is it all organic?

- What keywords?

- What can you rank on?

For example, a blog post can be a great way to get a white paper discovered in an organic search. Knowing all of this is super important. You want to make it easy for people to access and leverage your content. Leveraging content is going to be different with every company and every set of offerings. Look at your data and ask:

- What are people searching for?

- What are your salespeople and your sales engineers hearing?

- Knowing all of the answers to those questions will aid you in developing different formats.

Some people want to read, some people hate reading and want a webinar or a video, or they only want to read press coverage. You can get creative and produce a webinar that can be repurposed into a white paper which then could get repurposed into a blog post and then into a graphic. Just remember to have a consistent message because if what you put out in the market is inconsistent and doesn’t tell a connected story, that’s going to impact whether or not your audience wants to talk to you and buy from you.

For more B2G marketing insights, read the other blogs in this review of the Marketing for the Public Sector Content Marketing Review. And don’t forget to purchase your results report: a must have resource for GovCon marketing!

Related B2G Marketing Posts

Marketing 4 the Public Sector (M4PS) Study Recap

Marketing The Funnel and Delivering the Right Content at the Right Time

Creating Impactful B2G Content

Events and Webinars: where we are, where we’re going

Federal SLED and Marketing on a Budget

By Elizabeth Armet, Senior Director, Research Strategy

Qualitative research is ideally suited to gain a deeper understanding of the opinions, motivations, frustrations, and priorities of your target audience. There are numerous ways to achieve this level of understanding, primarily through focus groups and in-depth interviews (IDIs). Both methods can be highly effective at uncovering and unlocking valuable insights.

Focus groups

Using a predetermined set of questions that allow ample room to dive into previously uncharted yet relevant issues, a professional moderator encourages and manages an open discussion and the cross-pollination of ideas among the participants. While the size of the group can vary, most groups include 6-10 participants. The group may be conducted either in-person at a professional focus group facility or at other venues such as at a conference or convention; or else online. The number of groups depends on the audience type and the goal of the research; but in general, two groups are better than one. The second group serves as a confirmation (or dissension) of the first group’s findings and also provides the opportunity to delve into any additional issues or ideas that unexpectedly came up during the first group.

In-depth interviews (IDIS)

In-depth interviews are one-on-one discussions conducted by phone or an online platform such as Zoom or Google Meet. Like focus groups, they also follow a predetermined yet flexible guide and may last anywhere from 20-60 minutes. The total number of IDIs may vary, and depends on the audience type, with 10-15 interviews per segment as a reasonable amount. IDIs are a great tool when targeting a very specific decision-maker or executive that is harder to reach. The one-on-one format of IDIs is also well suited to topics of a sensitive nature, or when the participant seeks to avoid sharing information with a possible competitor.

Which method do you choose?

Typically, the specific circumstances of your research project will dictate whether focus groups, in-depth interviews, or perhaps even a combination, is most appropriate.

Focus groups are recommended for the following situations:

- Eliciting deeply held opinions and beliefs

- Obtaining detailed information from a small and potentially diverse group of individuals

- Evaluating a concept, message or ad

- Assessing a product or service

On the other hand, IDIs are recommended over focus groups in the following situations:

- The research requires the input of decision-makers from competing firms (who are often unwilling to talk openly in front of one another).

- The target audience is comprised of very high-level and/or extremely busy professionals, such as corporate executives or medical specialists, and may be unwilling to travel to a research facility at a specific time.

- The discussion topics are sensitive or personal in nature.

It is important that you and your research firm weigh each option carefully when determining the most effective qualitative method for your particular needs. Indeed, some studies may benefit by utilizing both approaches, based on the nature of the target audience. Market Connections works together with our clients to create the best strategy to get the answers they need with qualitative research.

What is custom content and why does it need to be part of your 2023 marketing plan?

by Susan Rose, Senior Director of Insights and Content

As part of a company that produces every type of content, we find “content” means different things to different people, and some new definition pops up every single day. This can make determining the right content mix to meet your business goals a bit of a challenge.

At GovExec, we talk about editorial content, sales content, and custom content. All types of content are an important part of a marketing strategy. Deciding which one to use in any given situation depends on what your expectations and needs are.

Fortunately, we have some research to help you figure that one out as you start working on your 2023 marketing plan. But first, what is custom content?

What custom content is NOT

It is important to know what it is NOT before diving into what it is. Custom content is neither editorial nor sales content.

Editorial content is designed to inform or entertain. It is what we call “newsworthy” because it tends to be about something happening in the moment, like coverage of a vote in Congress or the war in Ukraine. Editorial content is about what is happening on the ground.

Sales content, on the other hand, is created for the explicit purpose of generating sales. That means it will talk about how a specific product or a specific service is going to work for a public sector agency: what it’s going to do and why the client needs to purchase it. It will not be a broader discussion about the technology; it’s going to be about something very tangible.

Since that seems like the majority of content you see daily, what is custom content then?

What Custom Content is

Custom content is the practice of marketing via content a business funds or sponsors. Editorial content does not have any sponsor and sales content is all sponsor.

When a company underwrites a custom content piece, we work with them to determine the topic and what the audience needs to know or learn. Custom content is relevant and valuable to the audience, and as such helps build trust.

In general, custom content will be based on research. We will dig into studies and reports, or look at industry wide trends. The result will be an unbiased story about what the data means. This content relies on the knowledge of subject matter experts as well as reputable research sources.

Custom content includes native articles, research reports, webinars, podcasts, and videos. When you see something on our GovExec properties that says “sponsored by,” that means it is custom content and a company paid to create it. They helped determine the topic and the educational focus. They have NOT determined what we say because if the research doesn’t back up a specific point of view, we are not going to publish it. Our reputation is on the line. Custom content simply means the company had some influence in topic and direction, and therefore the piece is not pure editorial.

Why do you need to add Custom Content to your 2023 marketing plan?

Custom content is about building that trusted adviser relationship that your team wants to have with your public sector customers. Everything we do is geared toward that.

Why is this so important?

Glad you asked.

Market Connections conducts a variety of studies that look at public sector marketing and trends. Data from our three most recent studies come to the same conclusion: custom content resonates with your audience.

That is ultimately why you need to use it.

In the Market Connections Content Marketing Review, we asked public sector decision makers what kind of content they find most valuable overall. What this data shows is that the public sector values a range of content types.

When we remove editorial and sales content from the mix, you’ll see that custom content types are valuable to the audience—particularly fed and sled audiences.

A little background: We chose 14 different content types because these are all part of the public sector marketing mix.

The figure shows that overall, the public sector audience finds all of them valuable, and therefore are all a really good part of your content mix. Remember that.

But what this also shows is that when you remove editorial and sales content from the mix (which is what we’ve covered up) is that of the 14 content types, 10 are custom content.

Research Reports are highly regarded as valuable content, followed by white papers, and articles. Does that mean you need to spend all of your budget on research? Not necessarily. It depends on your budget and your annual goals. And while your audience really likes reports and white papers, you’ll notice that webinars still have a very high percentage of value to the audience.

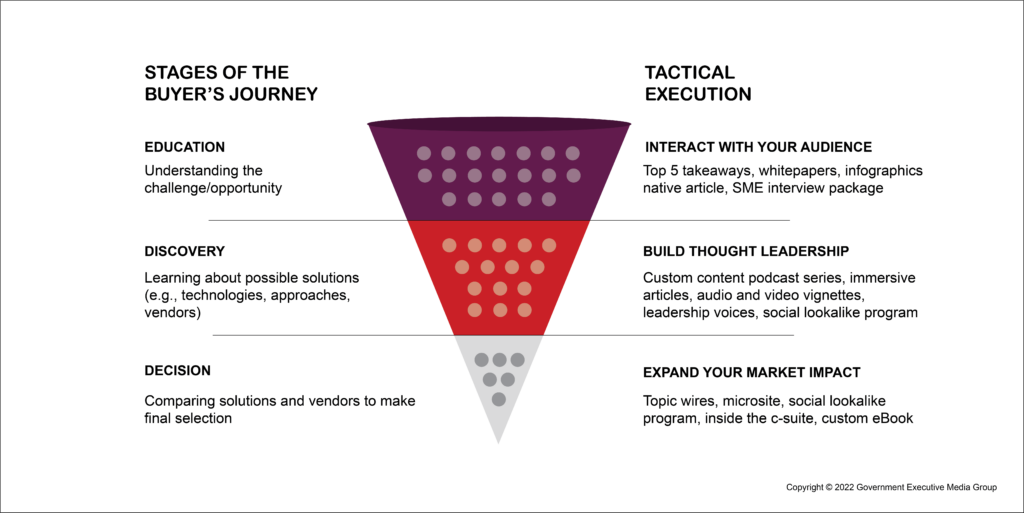

What does a custom content mix look like in action?

That’s a great question that only you can answer based on your marketing budget, initiatives, and company goals. This figure of the buyer’s journey illustrates where various types of content have impact along the journey. It’s important to address the audience at the various stages of the journey.

We suggest a mix of ebooks, webinars, articles, video, podcast, white papers, and so on–really anything from the list in the figure.

What we definitely suggest is getting the most out of the content you create. Repurpose, repurpose, repurpose.

Say you commission some custom research, you can get a research report, a white paper, a few articles, a webinar, a podcast, and more out of it. That will give you the most bang for your marketing dollar.

Need some help? Contact your GovExec sales rep to discuss a program to fit your needs. Or, contact me–I love talking content strategy! (srose@govexec.com)

Revisiting the Leading Brands 2021 Panel Discussion

Jonathan Sanders, Director, Research, GovExec

In the B2G space, there are few things more important than understanding your brand — it is the story you tell without ever walking into a room. It is the reaction someone has when they see your company mentioned online. It is the feeling they have when they see your company’s name on the sponsors and exhibitors page of an event.

Most importantly, it is what runs through the mind of agency leadership when they see your company has submitted a bid for a large-scale contract. Without a well defined brand, you don’t own that narrative. Internally, your team may have a strong grasp of your company’s positioning and offerings, but thousands of government decision makers, Service members, and the general public may have an entirely different view of your company.

My question for you today is: are you tracking that narrative?

The Leading Brands study offers a succinct view into the question of brand positioning and tracking. Now in its 8th year, Leading Brands is the largest government decision-makers study capturing the priorities and perceptions of buying teams across Civilian agencies, the Department of Defense (DoD), and state and local government (SLG) entities.

In short, Leading Brands allows your team to look under the hood of your brand. It provides a critical analysis of your customers and non-customers, how your company is perceived against its competitors, and market strengths and weaknesses. The goal: to accelerate sales, guide partnership development, and define go to market strategies.

Leading Brands is a great tool to measure your company’s brand and perception over time from key public sector individuals. But it is just the starting point to unlock your company’s overall potential. In May 2022, GovExec’s Insights & Research Group released the 2022 Leading Brands study with help from some long-time colleagues and leaders in the public sector. The study release event included a star-studded panel discussion consisting of Tim Hartman (CEO, GovExec), Tricia Davis-Muffett (Director, Global Public Sector Marketing, Google Cloud), Pamela Merritt (Managing Director, Federal Marketing and Communications, Accenture Federal Services), and Oliver Nutt (Vice President of Marketing, GDIT).

The panel of public sector leaders highlighted the efforts to drive brand awareness in the market and guide overall brand evolution while navigating a turbulent, crowded market. With a dynamic market whose needs are constantly evolving, it is increasingly important to note not only where your brand is, but where your brand will ultimately go. In order to peel back some of the key takeaways from this discussion, the Insights & Research Group is pleased to walk you through what our experts had to say.

The Importance of Studying One’s Brand

The importance of studying one’s brand cannot be overstated. If you are committing to regularly measuring your brand and competitors in the marketplace, you already have a lot in common with the largest companies serving the public sector. If you are not, you run the risk of not knowing how you are perceived, which can impact the company’s ability to win contracts.

When our panelists were asked how they went about measuring their brand, Leading Brands came first. Serving as a great benchmark, the study permits you to do research on incredibly specific market areas, whether it be how you are perceived across multiple public sector verticals, customer vs. non-customer information, or your brand’s association with leading concepts such as Cyber, Digital Transformation, AI, and Cloud, and more. This informative tool allows your team to zero in on a full-spectrum viewpoint of how they are broadly viewed across the public sector — knowledge the panelists value.

While it is massively important to know how your customers feel and interact with your brand, it is equally important to have insight as to how those inside your company view the company, too.

Tim Hartman, GovExec’s CEO said “Your brand only really exists in the hearts and minds of your employees and customers. People who are familiar with your brand, or have a relationship with your brand, really are what are driving the brand the most.”

GDIT’s Oliver Nutt noted that internal conversations with employees are a great tool for understanding the internal brand perception.

Accenture’s Pamela Merritt had one of my favorite insights during this discussion. She said that to measure a dynamic market, you need a dynamic market measuring tool and strategy. Underpinned by constant change, the public sector market is one that needs to be frequently studied and measured, which is exactly what Google Cloud’s Tricia Davis-Muffett and team are doing. “We’re doing more rapid measurement on a regular basis.” Studying and measuring one’s brand is a critical first step in developing go-to-market strategies that resonate with the broader public sector, but it is the first of many.

Aligning to the Core Brand

Another critical topic in the B2G space the panel discussed is that of alignment to the core values. Identifying and maintaining a set of core brand values and ideals and intentionally adhering to them in every move within the market is a necessity—this is what brings the brand to life.

All of the public sector agencies have one thing in common: People run them; ordinary people who have their own perceived notion of your brand. When you continuously align the company to its core brand values, it will be easier to understand how the people may view you in the marketplace. If your core brand values are inconsistent, it becomes difficult for individuals to understand what you stand for.

One of the most ancient axioms, “You’re only as good as your word,” feels just right in this discussion. If your company is not being intentional with its core brand values in the moves you make across the marketplace, those paying attention will begin to have doubts about your brand. This is particularly true for the public sector market that faces a barrage of new trends and buzzwords daily. With an ever-increasing scope of new widgets and tech trends, being able to authentically harness the energy of a particular marketing moment in a way that translates positively for your brand, yet celebrates and rings true to your core branding, is no easy task.

Merritt said: “If you want to move the needle on something, you need the entire company to be all in.” The closer you are able to align your company’s core values with the brand, you don’t only win from a brand performance perspective in the broader market, but you also win from an employee perspective. As Hartman noted, with a brand only existing in the hearts and minds of your employees and customers, who would be a better steward to go out to the market and share in the brand’s alignment to its core values? This panel is steadfast that going to market without knowledge of, or alignment to, the core brand is a recipe for disaster.

“If you want to move the needle on something, you need the entire company to be all in.”

— Pamela Merritt, Managing Director, Accenture Federal Services

Continuous Presence in the Market

Once your team has thoroughly studied your brand inside and out and has developed a strategy to move intentionally in the market that is aligned with your core brand values, a critical next step is to foster a continuous presence in the market overall.

When we say a continuing presence, we are not advocating for a response to each new trend or focus area, as there will be many. Rather, it’s understanding that different sectors have varying needs. Davis Muffett noted how important story-telling in the SLG space is. She said the SLG market wants to see something that is repeatable—a prospect in Kings County wants to know how this piece of technology solved the exact same problem for Los Angeles County. This is an incredibly powerful way to resonate with that audience. Sure there may be some differing elements, but what worked for one large county may be repeatable at another.

Conversely, every Federal agency is different. Their technical sets, organization structure, buying capability is all different, making each sale custom. It’s imperative to help them find their own vision rather than telling a story of how your brand helped a different agency through a similar solution.

Granted, these two small examples oversimplify the massive task vested with B2G marketers— each subsection in the public sector community has their own needs, their own challenges, their own opinion of your brand. That core brand has to be able to meet these unique needs in order to remain competitive.

Don’t Chase the Shiny

Keeping an ear to the ground on what’s going on in the market is a must for any marketing team in the B2G space, but that does not mean jumping on every new trend, tempting as that may be. The public sector space is rife with technologies, trends, and solutions that can be transformative for all levels of government. The ever popular trend of digital transformation lay dormant for much of the beginning of the 21st century, but springboarded off of the back of the Covid-19 pandemic, and is now the common lexicon for most large-scale modernization efforts.

But if your brand doesn’t do digital transformation, it is disingenuous to use the term when it couldn’t be further from what your brand does. Does familiarity with a certain trend make your company more viable, and more familiar to the customer?

Being intentional and transparent in the market is a powerful brand tool. Focusing on your brand promise and core values will pay dividends for you and your customer base. Not giving into the noise can ensure your brand’s messaging isn’t lost in today, or tomorrow’s trend. Too often brands reach to be current with trends or offerings that are not aligned with their value proposition, and in those moments they run the risk of alienating their current customers and reducing favorability in the coming years. Listen to the markets, identify the relevant services you provide, understand how they coincide with the core values, how they fold into today’s trends to solidify your offering.

When it comes to something new in the public sector, make sure your brand isn’t chasing the shiny just to remain current because you may just lose what originally made you shine.

The Bottom Line…

The importance of brand measuring and tracking cannot be overstated. Our panel of experts agree that if you are unfamiliar with how your brand is perceived, you may be missing out on massive opportunities to sway perception, create positive outcomes, and most importantly, winning contracts.

GovExec’s Insights & Research Group is your go to source for brand measuring and tracking. Whether Leading Brands, or a custom brand tracking tool, we are here to help guide all of your brand perception and tracking needs.

Questions? Find out more by contacting jsanders@govexec.com or research@govexec.com.