marketing strategy

B2G marketers: this article is part 4 of a 4-part series recapping the June 2023 Content Marketing Review.

B2G Marketing on a budget… we’ve all been there. Most of us live there permanently. At the Content Marketing Review, Susan Rose, Senior Director of Insights and Content, GovExec and Monica Mayk, Head of Marketing, U.S. Public Services, Tata Consultancy Services talked about marketing on a budget. Part 1 of this series answered the question, “If it was a perfect world and you had everything that you wanted, what would your marketing strategy look like?”

This panel answered: “Okay, we don’t have unlimited time, staffing or budget. How do we make all of this work?”

This panel answered: “Okay, we don’t have unlimited time, staffing or budget. How do we make all of this work?”

Investing More Money Into Marketing

A lot of people are wondering, “How can I implement a strategy when I have a micro budget? How do I work with a budget that’s tactical and get the results in return that superiors are wanting?”

Tight budgets are real. Yet senior leadership needs to understand that if they are not making a sufficient investment in marketing, the marketing units can’t be strategic or deliver the type of results they are looking for.

It is key for companies to set aside a certain amount of money for marketing so marketers can establish a reliable strategy that will result in their connected presence in the market. For example, when Monica worked with Verizon, she was on a shoestring budget. She only had a few hundred thousand dollars to support a two billion dollar business that was trying to sell into every federal agency. A few hundred thousand dollars wasn’t nearly enough to manage the vastness of the business, so she had to use that investment in creative ways to incur a reasonable outcome (listen to the on-demand recording to learn what she did).

Knowing the Portfolio is Key to B2G Marketing on a Budget

Knowing everything your company is selling under your portfolio is important in establishing a logical strategy. Referring back to Monica’s Verizon example, she had a gigantic portfolio and had little idea about some of the products and services that her company was selling. And she had to market solutions that people did not associate with the company’s brand. In fact, she almost had to work against the corporate and consumer brand by focusing solely on her priority, which at the time happened to be all of the federal agencies.

She established a process where she said, “let’s find the intersection between what we have to offer, what’s important to our customers, and who are the places we are selling to” so her company could establish some thought leadership and demonstrate some expertise. Through this process, she was able to narrow down the portfolio and pick a few key solutions that would connect to their customers and prospects. Security, connectivity and public safety were those initial priorities at the time. This process allowed Verizon to showcase key solutions and products that supported those specific themes that resonated with the agencies. By following this process, Verizon went from having no impact on the agencies to making their presence abundantly clear in the market.

Marketing Strategies

Conducting research and leveraging credible data that has been validated will always increase the trust the market has in you. Thought leadership and content campaigns, as well as advertising and awareness aspects, all aid in getting your message out there. A few B2G marketing methods that tend to be successful when you’re on a budget are:

- Articles

- White Papers

- Research Reports

- Advertising Messaging

Finding the right partner that will help you create, publish, promote, extend, and reuse content will end up being a high-value investment, because you are essentially receiving five things for the price of one. It is not only important to broadcast your content on your own website and LinkedIn account, but third party websites as well. Posting content on other sites increases your chance of reaching a larger audience.

Final Thoughts

It is important to note that marketing results will be measured over time. You cannot expect to garner results right away. That is one of the hardest things that finance teams cannot understand in the public sector. You have to wait three-to-five years before you start seeing practical results. As a prime example, Monica spent around a million dollars in marketing with Verizon over the course of three years on a single opportunity with one agency. After a five-year pursuit, Verizon won an agency single source contract for $2.3 billion dollars. A million dollar investment ended up turning into a $2.3 billion dollar, ten-year contract. This is just one of the many examples that proves if you invest a considerable amount toward your marketing budget then you can end up with an astonishing end result.

Get the Study

Want more? The Content Marketing Review is now available on demand. Click this link to learn more.

Related Posts

Marketing 4 the Public Sector (M4PS) Study Recap

Marketing The Funnel and Delivering the Right Content at the Right Time

Creating Impactful B2G Content

Events and Webinars: where we are, where we’re going

Federal SLED and Marketing on a Budget

B2G marketers: this article is part 1 of a 4-part series recapping the June 2023 Content Marketing Review.

At the Content Marketing Review, B2G marketing experts Anna Pettyjohn, Senior Vice President of Marketing, GovExec and Lisa Sherwin Wulf, Founder and Marketing Consultant, LSW Marketing spoke about marketing the funnel and delivering the right content at the right time. Their conversation centered on their experiences and knowledge when it comes to B2G content marketing and emphasized the importance of needing time, a larger budget, and resources to aid in successfully executing on all strategies.

At the Content Marketing Review, B2G marketing experts Anna Pettyjohn, Senior Vice President of Marketing, GovExec and Lisa Sherwin Wulf, Founder and Marketing Consultant, LSW Marketing spoke about marketing the funnel and delivering the right content at the right time. Their conversation centered on their experiences and knowledge when it comes to B2G content marketing and emphasized the importance of needing time, a larger budget, and resources to aid in successfully executing on all strategies.

For the full study results and key takeaways, see the On-Demand presentation.

The Challenges We all Face

B2G marketers have two challenges in common, and Lisa and Anna shared how they handle them:

- Budget, Resources, and Time: You have to be realistic. You have to take a look at what resources you possess. What’s your budget? Do you have SMEs? Do you have enough people to create the content? What kind of traffic do you already have? How can you execute? Do you have customers that are willing to speak? It always comes down to your budget, resources, and time.

- Getting Everyone On The Same Page: Another big challenge is your sales team. You want your pitch to resonate with your customers, and that means giving them the information they want and need. Creating a tangible roadmap for milestones so everyone is on the same page can be an effective way to ensure initial priorities are still being met.

In a Perfect B2G Marketing World…

Lisa said that in a dream world, once you have your budget, resources, partners, and vendors established, you would next want to know the foundational concepts. For example:

- What are your business goals?

- Do you have documented messaging that’s adjusted for the public sector as needed?

- Do you have campaign themes defined?

- Do you have SMEs?

Having the time and budget allows for creativity within the foundational process. After you’ve understood the overall foundation, then you want to get an idea of the inventory of existing assets. Even with an unlimited budget and time, you still want to look at what you are trying to convey.

- What are your customers going to learn?

- How do they want to learn?

- What are your themes?

You may get lucky and things may already exist that you could reuse. Last but not least, in this perfect world, you’d have an SEO team, designers, a video team, and intent data and email nurturing to help share relevant content.

Making sure your content finds the audience

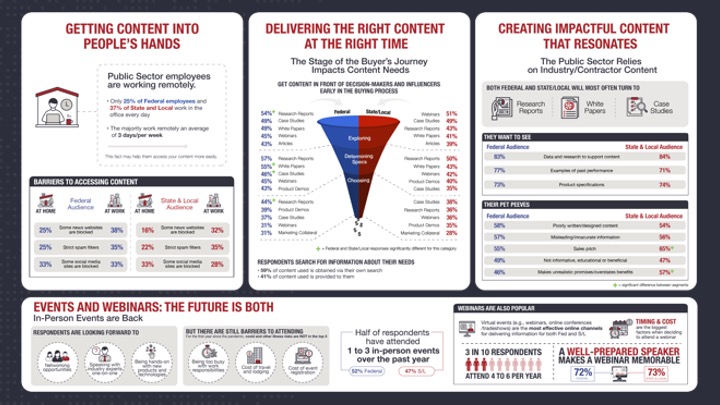

The biggest takeaway from this panel is that whether someone is working from home, working in the office, or traveling, providing content throughout all stages of the funnel is critical.

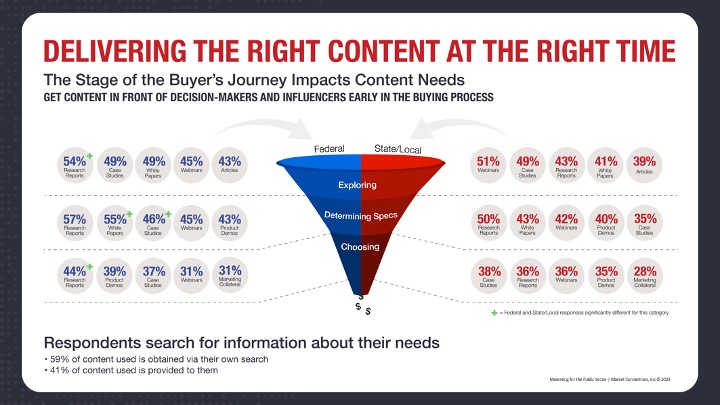

Webinars, research, white papers, and search engines resonate across the different stages of the funnel, but the specific focus and information will change.

If you do not have an SEO team, it is essential to look at how your audience can discover your content and ask the following questions.

- How are you promoting on social media?

- Do you have the budget for paid search?

- Is it all organic?

- What keywords?

- What can you rank on?

For example, a blog post can be a great way to get a white paper discovered in an organic search. Knowing all of this is super important. You want to make it easy for people to access and leverage your content. Leveraging content is going to be different with every company and every set of offerings. Look at your data and ask:

- What are people searching for?

- What are your salespeople and your sales engineers hearing?

- Knowing all of the answers to those questions will aid you in developing different formats.

Some people want to read, some people hate reading and want a webinar or a video, or they only want to read press coverage. You can get creative and produce a webinar that can be repurposed into a white paper which then could get repurposed into a blog post and then into a graphic. Just remember to have a consistent message because if what you put out in the market is inconsistent and doesn’t tell a connected story, that’s going to impact whether or not your audience wants to talk to you and buy from you.

For more B2G marketing insights, read the other blogs in this review of the Marketing for the Public Sector Content Marketing Review. And don’t forget to purchase your results report: a must have resource for GovCon marketing!

Related B2G Marketing Posts

Marketing 4 the Public Sector (M4PS) Study Recap

Marketing The Funnel and Delivering the Right Content at the Right Time

Creating Impactful B2G Content

Events and Webinars: where we are, where we’re going

Federal SLED and Marketing on a Budget

Exclusive Information Session and Networking Event Happening on 6/29

With the plethora of information sources available at our fingertips, sifting through and narrowing down the data required to map out effective marketing plans and strategies can take considerable time and effort. We want to help.

Formerly brought to you under a different title, Content Marketing Review, the spring iteration of our two part Marketing for the Public Sector (M4PS) study answers questions like when, where, and how the public sector prefers to receive information about products and services. For example:

- One third of respondents use LinkedIn for news related to their job vertical.

- The favorite format for job-related information and education is explainer videos.

- Well prepared presenters make for memorable webinars.

Launching on June 29th, 2023 at an exclusive networking event (happening in Tysons, VA), a panel of industry experts will dive into the current outlook regarding participation in in-person/virtual events and media/content format preferences.

Here are five reasons YOU should consider attending:

- 1) In-person networking opportunity.

- 2) Pertinent, actionable information for marketing plans/strategies.

- 3) Insights into public sector audience content preferences.

- 4) Types of content respondents prefer throughout the buying process.

- 5) High quality research you can act on.

Whether you are interested in a broad awareness campaign or a more focused agency-based marketing effort, this information session will help you measure the preferences of your public sector audiences.

Event details

The M4PS Content Marketing breakfast will be held on June 29th at The Archer Hotel in Tysons, VA from 8:00AM-11:00AM. Register today and join us for breakfast, in-person networking and an informational presentation by a group of industry experts.

Early bird pricing available until 6/12.

Federal & State and Local Government Respondents Looking Forward to Networking Opportunities, Speaking with Industry Experts One-on-One, Being Hands-On with New Products and Technologies

Washington, DC / Monday, May, 22, 2023 — The research team at Market Connections Inc is releasing part two their Marketing for the Public Sector study at an exclusive information session happening in Tysons Corner, Virginia.

Industry experts will join President of Research and Forecasting at GovExec, Aaron Heffron, to present findings from the spring iteration of the Marketing 4 the Public Sector Study (M4PS): Content Marketing. Attendees will include marketing and communications leaders within the U.S. public sector. The exclusive information session and breakfast networking event is happening in Tysons, VA on Thursday, June 29th, at the Archer hotel.

Formerly the Content Marketing Review, the spring M4PS study answers pertinent questions about when, where, and how the public sector prefers to receive information about products and services. This information is critical in helping marketing and communications professionals develop actionable content marketing strategies.

Highlights from the study include:

- One third of respondents use LinkedIn for news related to their job vertical.

- The favorite format for job-related information and education is explainer videos.

- Respondents look to different types of content depending on where they are in the buying process.

- Respondents favor in-person events over virtual.

“In person events are back. While it’s still important to offer hybrid options, people are eager to get out and meet peers and vendors face-to-face,” said Heffron. “It is also important to note that the public sector turns to different content types depending on where they are in the buying process. That underlies the importance of creating a marketing strategy that hits each touchpoint.”

Regardless of company size or marketing budget, attendees of the M4PS breakfast can expect to leave the information session with pertinent, actionable information to inform marketing plans and strategies.

Early bird pricing ends June 12, 2023. Only a limited number of tickets are available, so register now to reserve your spot.

About Market Connections

Market Connections; a portfolio platform of GovExec, delivers trusted, actionable intelligence and insights that enable improved business performance and positioning for leading businesses, government agencies and trade associations. The custom market research firm is a sought-after authority on preferences, perceptions and trends among government executives and the contractors who serve them, offering deep domain expertise in information technology and telecommunications; healthcare; and education. Market Connections also provides the tools for organizations to expand thought-leadership in their respective markets and is known for its annual Marketing 4 the Public Sector study, the only comprehensive survey of the media habits of federal and state/local decision-makers, as well as the Federal IT (FIT) Personas Study. For more information, please visit: www.marketconnectionsinc.com.

When it comes to reaching public sector audiences there are a number of things to try, a number of avenues to venture down, and a number of platforms to spread your message on. If you’re reading this, you’re already aware of that.

Yet, with the plethora of information sources at our fingertips, it can be hard to narrow down the specific data needed to begin formulating marketing plans and strategies. That is why the Market Connections research team created a study specifically for the individuals and teams Marketing for the Public Sector (M4PS).

Part one of the study launched in October 2022 and provides insight into media engagement habits. Part two, slated to launch in June 2023, will get more specific, diving into the procurement and buying processes, current outlook regarding participation in in-person/virtual events, as well as media/content format preferences.

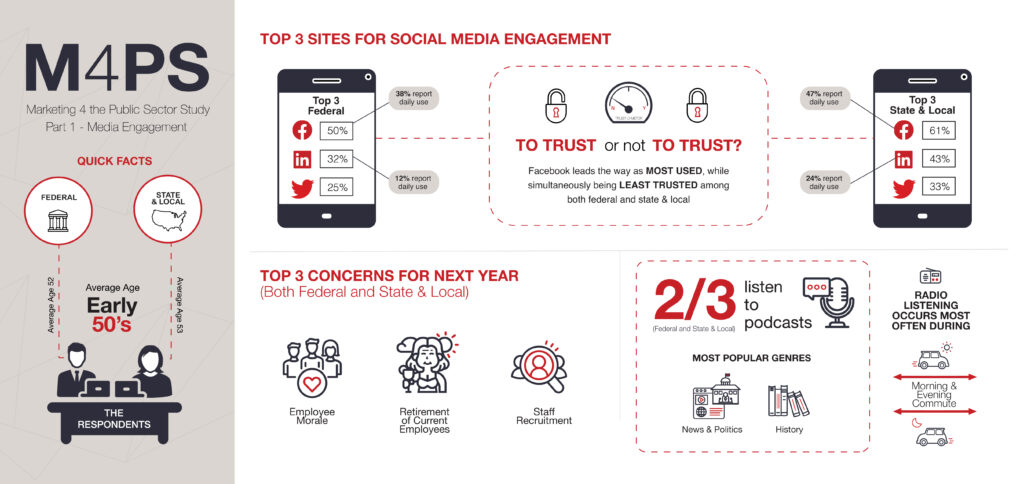

Overview

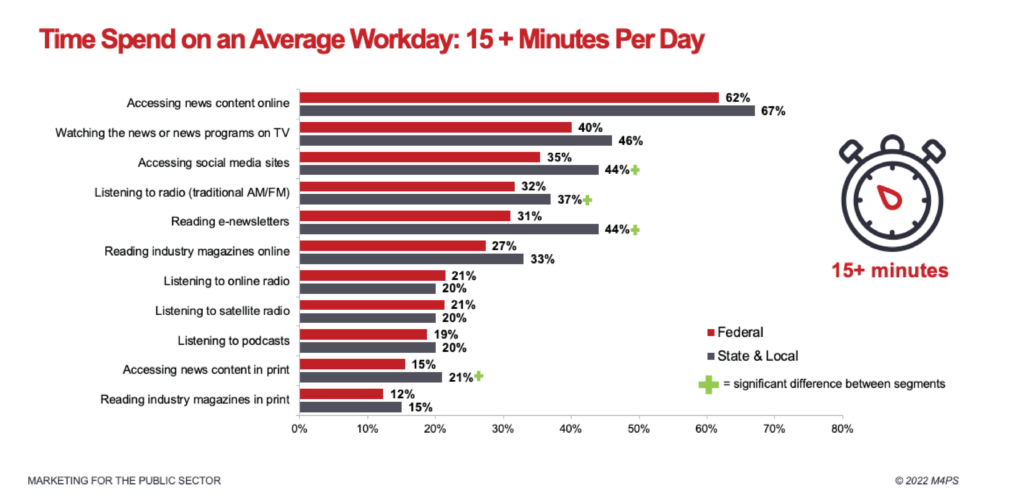

We surveyed more than 1,000 people working in the federal and state/local government about their media engagement habits. We asked them about:

- Top concerns for the next year

- How much trust do they have in the information they get from certain sources

- How much time is spent on an average workday accessing certain media

- Top digital sites for getting news/information

- Confidence in news sources

- Social media usage

- Top sites for streaming

- Data/information on podcast listenership

Included are key insights, observations and takeaways from analysts – as well as specific data on the DMV market (D.C. Maryland, and Virginia region.) Whether you are interested in a broad awareness campaign, or a more focused agency-based marketing effort, our aim with part one of the M4PS report is to provide you with trusted data, ultimately serving as launching point for your future planning endeavors.

What is important to your audience

Figuring out what’s important to your audiences is key. It allows you to make decisions with a wider lens or narrow down and go niche if necessary.

By arming yourself with both parts of this report you will be able to further strategically position yourself exactly where you want to be in the public sector market. Since all goals are different and there is no one-size-fits-all approach to planning, we started here by anticipating your needs, so you can in turn begin to anticipate the needs of your audiences.

The media engagement report is available now.

And keep an eye and ear out for M4PS part two, coming in June 2023.

Have questions? Want more information? Please reach out to info@marketconnectionsinc.com.

By Susan Rose, Senior Director of Insights & Content

Now that we’re in Q1, content strategies are a big component of planning out the work my team is doing. I noticed that one of the key pieces of a content strategy that I don’t typically see in the plan is how long the various pieces of content will last. Considering how much work we need our content to do for us, this seems important.

Let’s be real: marketing content, in general, is not breaking news. There may be news events that logically tie into the content, but the meat of the content itself typically lasts longer than a few days.

How much longer? That’s the question.

In fact, it’s a question we asked in the Content Marketing Review. The study reaches decision makers across the public sector, and these questions focused specifically on content they rely on during the buying phase of the journey.

The shelf life of public sector content.

We asked respondents how long they use different content types: more or less than six months. Overall, written content types that provide unbiased information are most likely to have a shelf life over six months—case studies, eBooks, white papers, and research reports.

This is good news for those who have incorporated case studies, eBooks, white papers, and research reports into the content plan as they tend to require a larger investment in both time and budget. We’ve seen clients use these pieces for a year or longer. In fact, we use data from our own marketing research studies on average for two years (not all data stays relevant that long, but some does).

Videos, podcast, blogs, and webinars are also an important part of the content mix, although they have a shorter shelf life overall. Even still, there are plenty of people who hang onto that content for some time.

What content should you invest in?

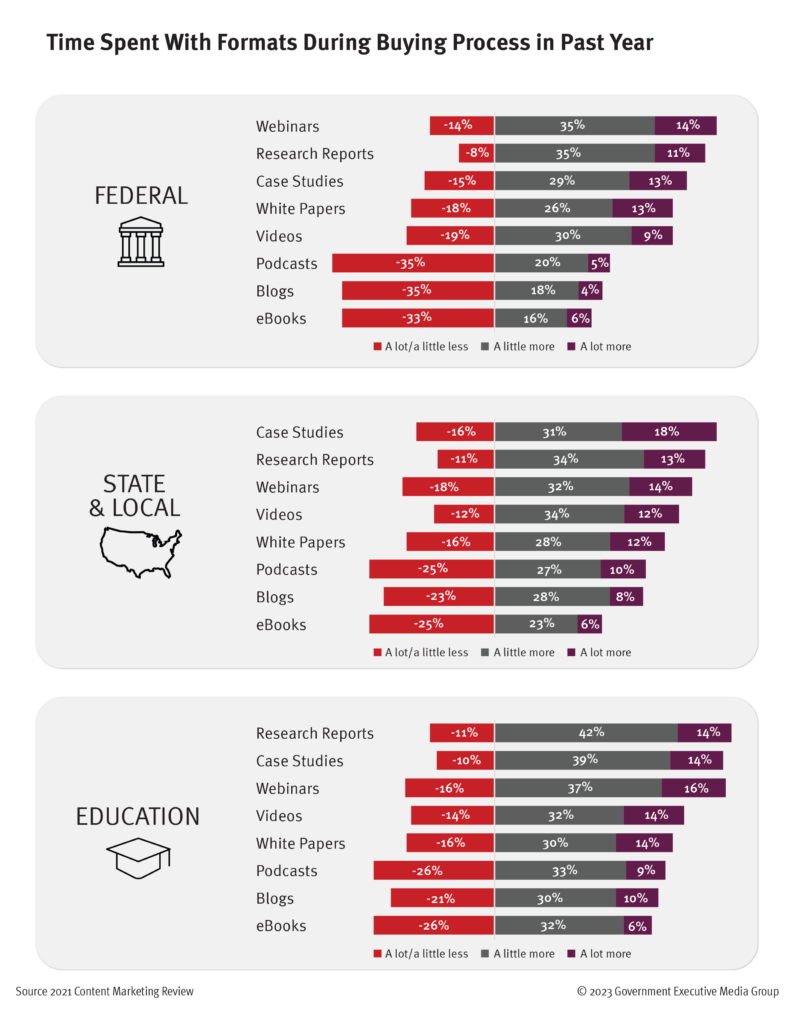

Knowing that the content will be useful for some time, which pieces are best to invest in? Engagement is a key indicator of value, so we asked how much time respondents spent with each content type during the buying process in the previous year.

For all audiences, research reports, webinars, and case studies are the top content during the buying process. Podcasts, eBooks, and blogs are the least used. This doesn’t mean they aren’t important, just that they won’t factor as much into the buying process.

What this means for your content strategy

This data drives home the point that different types of content are best at different stages of the buyer’s journey.

Building awareness? A great blog or webinar will start establishing trust in the brand.

Making the case for a sale? Bring in the research and case studies—the buyers need examples and data to make decisions.

If you need more data on what buyer’s want during their buyer journey, check out our Federal IT Buyer’s Journey study. While it focuses on federal IT, the information is useful across the public sector.

Marketing 4 the Public Sector Study - Part 1

Full report available Friday December 9th, 2022

ABOUT THE STUDY

The Marketing for the Public Sector report represents the views of thousands of federal and state/local employees in a variety of positions.

Focusing on engagement within the digital landscape, this study is meant to empower marketers with the knowledge they need to perfect their marketing plans, campaigns, and content.

Created in an easily digestible and navigable format, the report presents pertinent information about audiences’ media engagement habits across broadcast, social, and digital sources.

Whether you are interested in a broad awareness campaign or a more focused agency-based marketing effort, we want to give you the valuable, trusted data and insights on the media and engagement habits of those tough-to-reach federal and state/local audiences.

WHAT TO EXPECT

- Full Report – Contains data and insights on both federal and state/local customers

- Topics Covered – Demographics, job functions, trust in media sources/social media websites, confidence in news (among others)

- Publications & Digital Sites – Government media, business and news media, technology & industry, social media & lifestyle

- Key Insight – Top concerns for next year, time spent listening to news/radio, accessing social/news media on an average workday, most trusted social media sites

Visual infographic:

2022 Update

STAY CONSISTENT TO REACH TARGET AUDIENCES

In the last few years the way we seek and receive news has been changing and evolving faster than ever. Between the COVID-19 pandemic more or less forcing many companies to adapt to work from home trends, team collaboration needs, and an industry wide push toward cloud, things are getting more digital by the day.

While many people still start mornings off with a newspaper, listening to the radio on the commute to work, or gathering around the TV for the evening news, they don’t confine news consumption to those times. Increasingly, most likely due to the ubiquity of remote work and the convenience of cell phones and apps, people are engaging with news outlets and seeking out important updates from various digital sources throughout the day, a trend public sector marketers can (and should) take advantage of.

LEARN MORE MEDIA TRENDS

Part 1 of the 2-part 2022 Marketing for the Public Sector (M4PS) study looks at media engagement among both federal and state/local audiences.

Brought to you in a neatly packaged two part study, M4PS, called “maps” for short, focuses on the digital world around us. A first look at highlights from the M4PS study were presented to attendees at Government Marketing University’s GAIN conference, and part one of the full report will be available to purchase in November.

STAY UP ON TRENDS AND BE WILLING TO ADJUST ACCORDINGLY

Market Connections will continue to look at trends and impacts on federal and state and local employees’ media usage and preferences. Learning where your potential customers go for news and information can be fabulously useful in building a marketing plan. A better understanding of demographics, “go-to” news sources and most trusted social media channels can help you consistently put your message where their mind is.

Federal and state/local customers, just like the rest of us, are affected by outside factors. Marketers can’t always rely on by-the-book and tried-and-true methods of the past. A willingness to stay on top of current trends and adjusting current strategies based on new information is a must.

Need data to help make informed purchasing decisions? Our M4PS study provides the information you need.

Need more custom research to learn about your customer’s needs, challenges, perceptions and preferences? Reach out today. We’d love to help!

B2G marketers often reach out to us for data and insights on how to strengthen their business proposition, get in front of their customers and help their sales team with lead generation. As a market research company, we conduct interviews, focus groups and surveys to help our government contracting customers refine their strategies for a stronger return on investment.

Who Are You Targeting?

The first request we usually get is “I only want to hear from the C-suite,” with the assumption that these individuals are THE key drivers of any procurement.

The first request we usually get is “I only want to hear from the C-suite,” with the assumption that these individuals are THE key drivers of any procurement.

Our follow up question is, who sits around the boardroom table influencing those (C-suite) decisions? Who is writing the recommendation memo? Chief officers do not make decisions in a vacuum, but instead surround themselves with their staff to help understand the challenges of their work, gather feedback on their perceptions and experiences with vendors and provide recommendations and/shortlist prospective contractors. The Federal IT Personas Study focuses on those folks around the table with top execs who influence and advise throughout the procurement process.

Have you identified those trusted advisors and influencers and targeted them as well? Do you understand their motivations and preferences? A procurement officer’s issues will differ vastly than a technical expert’s or a program manager’s. Understanding what is important in their decision-making, what motivates them at work, how they prefer to get information, etc., can help you develop the right strategy that educates, influences and creates trust with your targets.

What Information Are You Providing?

Once you have identified WHO you want to talk to, the next step is WHAT you want to provide them with. What works with corporate or B2C audiences does not necessarily translate in the public sector market.

First, your content needs to educate your audience. The Content Marketing Review revealed that across the public sector landscape, IT influencers and decision makers are hungry for content containing data and research, as well as examples of past experiences and case studies. Whether federal, state and local, or education, research reports, white papers, case studies and product demos top the list of types of content. Regardless of whether they are starting to develop their requirements or finalizing their selection of vendor, understanding what your audience is looking for can help you become a trusted vendor.

Narrowing down the WHAT helps focus your resources and budget dollars. What content gives you the most bang for your buck? Where will you get the biggest ROI? Having those insights, your content creation strategy becomes easier to assemble and you can focus on the next question.

Where Is Your Audience Going for Information?

The final piece of the puzzle for public sector marketers once they’ve created great content is WHERE to place it. We remind our clients that creating great content is not a one and done scenario. One needs to share that content with their audiences where they already are, including speaking opportunities at events, webinars, in earned and sponsored media, social media, or other platforms.

Going where your customer already is, prompts the questions, “Where are they going for information, what sources do they trust, and how can you get and stay in front of them?”

Instead of throwing spaghetti on the wall and hoping it will stick, this information is already out there for you. The Federal Media & Marketing Study looks at the media consumption and marketing tactics preferred among federal audiences. It takes into consideration all types of media including print, online, television, radio, and other channels such as social media, podcasts, events and webinars. Based on a survey to thousands of federal respondents, the database provides findings that can be drilled down to detailed agency types, agencies, product categories, role at the agency, location or other demographics.

Final Thought

With answers to the questions “WHO, WHAT and WHERE,” B2G marketers can create a strategy for understanding their target audiences and provide them the information they are looking for in the places they are looking for it. Syndicated studies from Market Connections or further investments in custom research can provide those answers and insights for agency or target-based marketing, a small investment that can increase the ROI of everyone’s marketing efforts.

Want to learn more about research in the public sector? Contact us.

For more information about the following studies:

Aaron Heffron, President, Market Connections

From the Desk of Aaron Heffron, President, Market Connections, Inc.

As we fully engage into our 2021 marketing and sales plans, it’s important to know, “are we exploring or expanding?” As we have written about in the past, many areas in the public sector market have reached a certain level of maturity. Many companies now find themselves firmly entrenched in delivering services and products to federal, state, or local agencies. These contracts—years in the making and with returns on investment continuing for the next 3-5 years—can provide a sense of security for any business. As a marketer, at this point, what is your next step? Will you be an explorer or an expander?

Explorers that we read about in textbooks or learn through stories told across generations are often driven by the need to see places they’ve never seen and find things that have never been found. In business this is reflected in companies that develop new products and reach out to markets they have never touched before. New markets are higher risk, but the potential rewards are great.

Expanders are people, and companies, who deepen their roots and influence in their local communities, or grow their relationships with their current customers. These relationships secure businesses for the long term and create new connections among the same people, establishing bonds that are harder to break.

As a marketer supporting sales, product and operation, the information you need to make a sound decision is different when you support an explorer versus an expander.

Recent polling of the federal workforce highlights some of the challenges facing markets, who must develop the messaging and channel to best connect with current and potential customers.

- When seven out of ten federal workers report that they are likely to be working outside of normal business hours because of COVID and telework issues [check out our webinar] you have an opportunity to expand your connection with you customers by supporting them wherever and whenever they need it.

- The same number of federal buyers trust the information [see report] from vendors as those who distrust them – a foreboding landscape for any marketing and collateral material. What’s your plan to build trust as you explore?

- Nearly 20% of federal workers are questioning whether they will ever attend large trade shows and events again. How can you expand your relationships with individuals you can’t meet face-to-face in the near future, or ever?

- With commute times dropping as individuals look to a future of blended remote and in person work, how can you support your explorers and make your company known in other ways to those markets that have never heard of you?

Whether your goal is expansion, exploration, or a little of both, investing in data and information on your current or potential customers can help you leverage your limited budget for maximum impact. You would never set out on a new adventure without a map or detailed recognizance. (Remember that time you “thought” that was the right turn?) Your sales teams would never walk into a customer meeting with the presumption they always know what the customer needs. We live in an information age. An investment in information is worthwhile for those boldly going forth into new territories or those treading carefully in familiar territory.